Summary

We consider the problem of determining the L\'evy exponent in a L\'evy model for asset prices given the price data of derivatives. The model, formulated under the real-world measure $\mathbb P$, consists of a pricing kernel $\{\pi_t\}_{t\geq0}$ together with one or more non-dividend-paying risky assets driven by the same L\'evy process. If $\{S_t\}_{t\geq0}$ denotes the price process of such an asset then $\{\pi_t S_t\}_{t\geq0}$ is a $\mathbb P$-martingale. The L\'evy process $\{ \xi_t \}_{t\geq0}$ is assumed to have exponential moments, implying the existence of a L\'evy exponent $\psi(\alpha) = t^{-1}\log \mathbb E(\rm e^{\alpha \xi_t})$ for $\alpha$ in an interval $A \subset \mathbb R$ containing the origin as a proper subset. We show that if the initial prices of power-payoff derivatives, for which the payoff is $H_T = (\zeta_T)^q$ for some time $T>0$, are given for a range of values of $q$, where $\{\zeta_t\}_{t\geq0}$ is the so-called benchmark portfolio defined by $\zeta_t = 1/\pi_t$, then the L\'evy exponent is determined up to an irrelevant linear term. In such a setting, derivative prices embody complete information about price jumps: in particular, the spectrum of the price jumps can be worked out from current market prices of derivatives. More generally, if $H_T = (S_T)^q$ for a general non-dividend-paying risky asset driven by a L\'evy process, and if we know that the pricing kernel is driven by the same L\'evy process, up to a factor of proportionality, then from the current prices of power-payoff derivatives we can infer the structure of the L\'evy exponent up to a transformation $\psi(\alpha) \rightarrow \psi(\alpha + \mu) - \psi(\mu) + c \alpha$, where $c$ and $\mu$ are constants.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

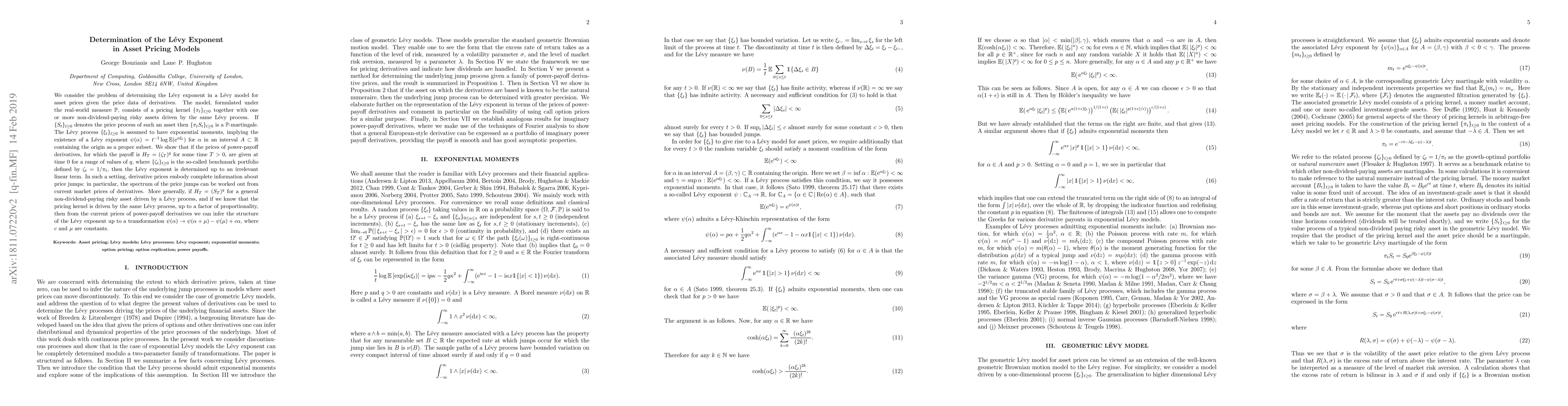

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)