Summary

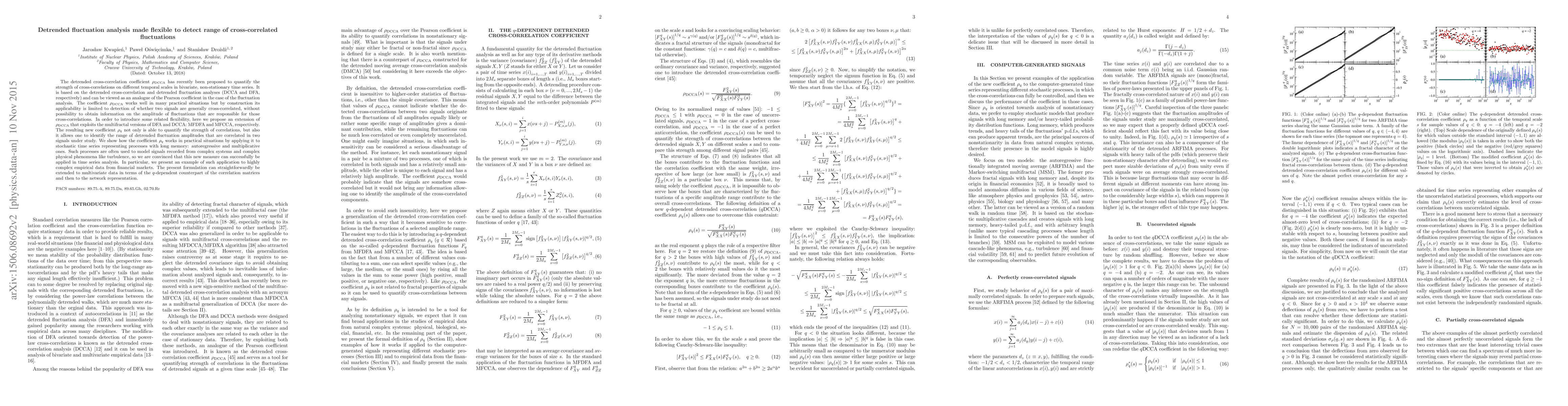

The detrended cross-correlation coefficient $\rho_{\rm DCCA}$ has recently been proposed to quantify the strength of cross-correlations on different temporal scales in bivariate, non-stationary time series. It is based on the detrended cross-correlation and detrended fluctuation analyses (DCCA and DFA, respectively) and can be viewed as an analogue of the Pearson coefficient in the case of the fluctuation analysis. The coefficient $\rho_{\rm DCCA}$ works well in many practical situations but by construction its applicability is limited to detection of whether two signals are generally cross-correlated, without possibility to obtain information on the amplitude of fluctuations that are responsible for those cross-correlations. In order to introduce some related flexibility, here we propose an extension of $\rho_{\rm DCCA}$ that exploits the multifractal versions of DFA and DCCA: MFDFA and MFCCA, respectively. The resulting new coefficient $\rho_q$ not only is able to quantify the strength of correlations, but also it allows one to identify the range of detrended fluctuation amplitudes that are correlated in two signals under study. We show how the coefficient $\rho_q$ works in practical situations by applying it to stochastic time series representing processes with long memory: autoregressive and multiplicative ones. Such processes are often used to model signals recorded from complex systems and complex physical phenomena like turbulence, so we are convinced that this new measure can successfully be applied in time series analysis. In particular, we present an example of such application to highly complex empirical data from financial markets. The present formulation can straightforwardly be extended to multivariate data in terms of the $q$-dependent counterpart of the correlation matrices and then to the network representation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)