Summary

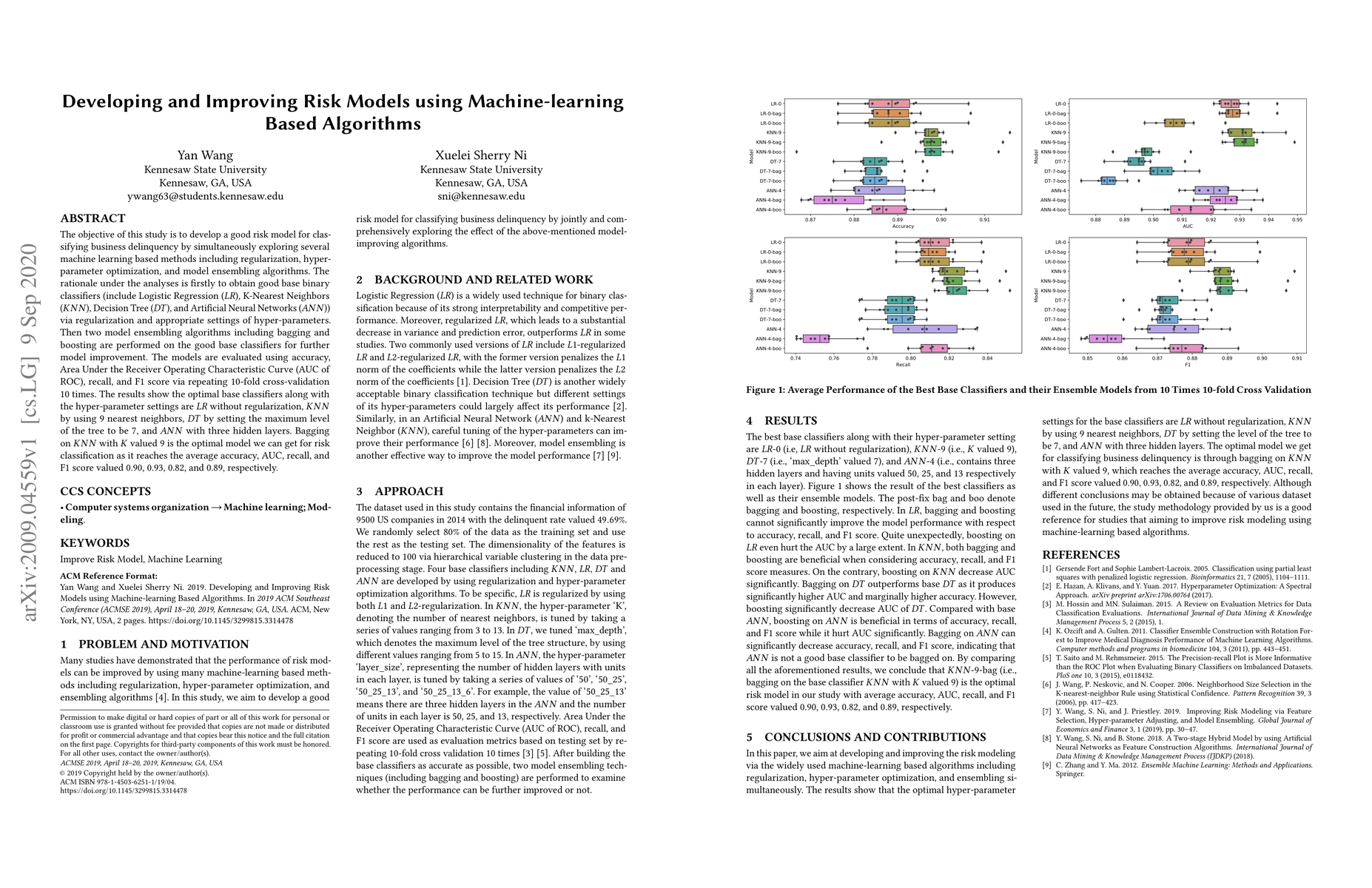

The objective of this study is to develop a good risk model for classifying business delinquency by simultaneously exploring several machine learning based methods including regularization, hyper-parameter optimization, and model ensembling algorithms. The rationale under the analyses is firstly to obtain good base binary classifiers (include Logistic Regression ($LR$), K-Nearest Neighbors ($KNN$), Decision Tree ($DT$), and Artificial Neural Networks ($ANN$)) via regularization and appropriate settings of hyper-parameters. Then two model ensembling algorithms including bagging and boosting are performed on the good base classifiers for further model improvement. The models are evaluated using accuracy, Area Under the Receiver Operating Characteristic Curve (AUC of ROC), recall, and F1 score via repeating 10-fold cross-validation 10 times. The results show the optimal base classifiers along with the hyper-parameter settings are $LR$ without regularization, $KNN$ by using 9 nearest neighbors, $DT$ by setting the maximum level of the tree to be 7, and $ANN$ with three hidden layers. Bagging on $KNN$ with $K$ valued 9 is the optimal model we can get for risk classification as it reaches the average accuracy, AUC, recall, and F1 score valued 0.90, 0.93, 0.82, and 0.89, respectively.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)