Summary

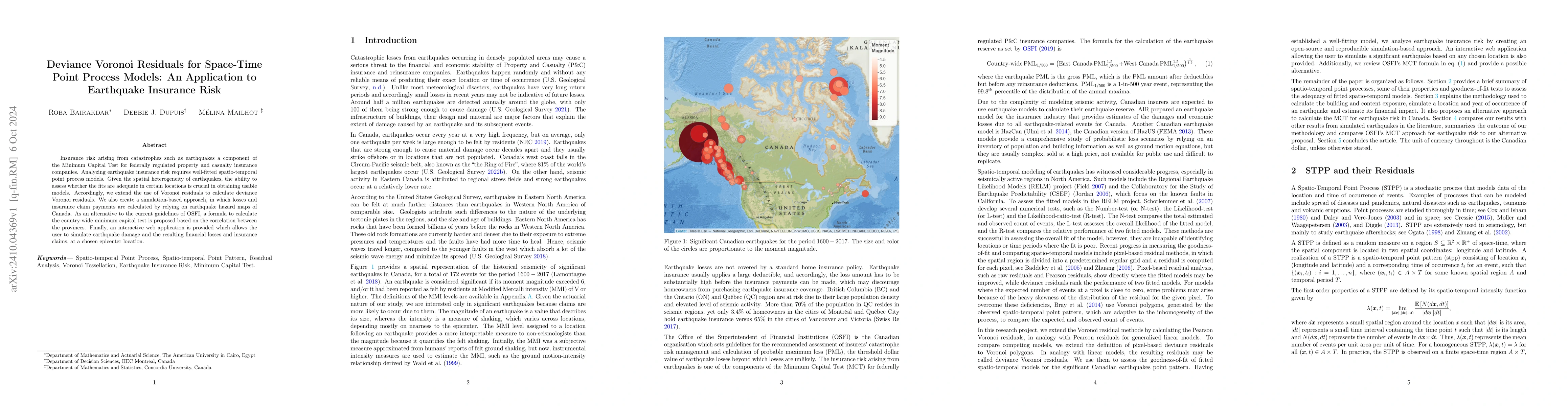

Insurance risk arising from catastrophes such as earthquakes a component of the Minimum Capital Test for federally regulated property and casualty insurance companies. Analyzing earthquake insurance risk requires well-fitted spatio-temporal point process models. Given the spatial heterogeneity of earthquakes, the ability to assess whether the fits are adequate in certain locations is crucial in obtaining usable models. Accordingly, we extend the use of Voronoi residuals to calculate deviance Voronoi residuals. We also create a simulation-based approach, in which losses and insurance claim payments are calculated by relying on earthquake hazard maps of Canada. As an alternative to the current guidelines of OSFI, a formula to calculate the country-wide minimum capital test is proposed based on the correlation between the provinces. Finally, an interactive web application is provided which allows the user to simulate earthquake damage and the resulting financial losses and insurance claims, at a chosen epicenter location.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

No citations found for this paper.

Comments (0)