Authors

Summary

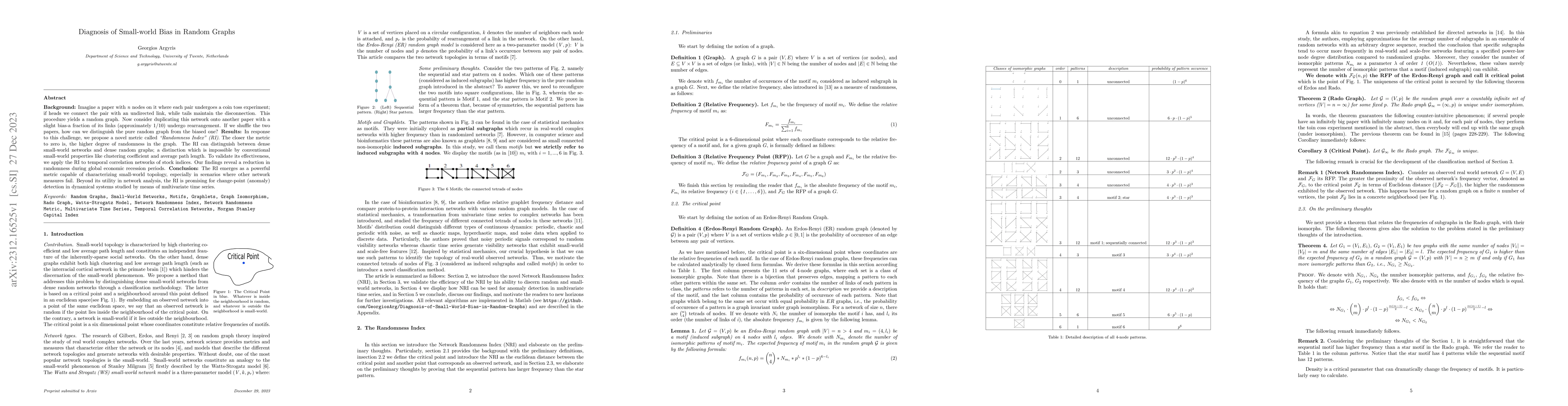

Background: Imagine a paper with n nodes on it where each pair undergoes a coin toss experiment; if heads we connect the pair with an undirected link, while tails maintain the disconnection. This procedure yields a random graph. Now consider duplicating this network onto another paper with a slight bias-a fraction of its links (approximately 1/10) undergo rearrangement. If we shuffle the two papers, how can we distinguish the pure random graph from the biased one? Results: In response to this challenge, we propose a novel metric called Randomness Index (RI). The closer the metric to zero is, the higher degree of randomness in the graph. The RI can distinguish between dense small-world networks and dense random graphs; a distinction which is impossible by conventional small-world properties like clustering coefficient and average path length. To validate its effectiveness, we apply the RI to temporal correlation networks of stock indices. Our findings reveal a reduction in randomness during global economic recession periods. Conclusion: The RI emerges as a powerful metric capable of characterizing small-world topology, especially in scenarios where other network measures fail. Beyond its utility in network analysis, the RI is promising for change-point (anomaly) detection in dynamical systems studied by means of multivariate time series.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)