Authors

Summary

Current trends in Machine Learning prefer explainability even when it comes at the cost of performance. Therefore, explainable AI methods are particularly important in the field of Fraud Detection. This work investigates the applicability of Differentiable Inductive Logic Programming (DILP) as an explainable AI approach to Fraud Detection. Although the scalability of DILP is a well-known issue, we show that with some data curation such as cleaning and adjusting the tabular and numerical data to the expected format of background facts statements, it becomes much more applicable. While in processing it does not provide any significant advantage on rather more traditional methods such as Decision Trees, or more recent ones like Deep Symbolic Classification, it still gives comparable results. We showcase its limitations and points to improve, as well as potential use cases where it can be much more useful compared to traditional methods, such as recursive rule learning.

AI Key Findings

Generated Sep 03, 2025

Methodology

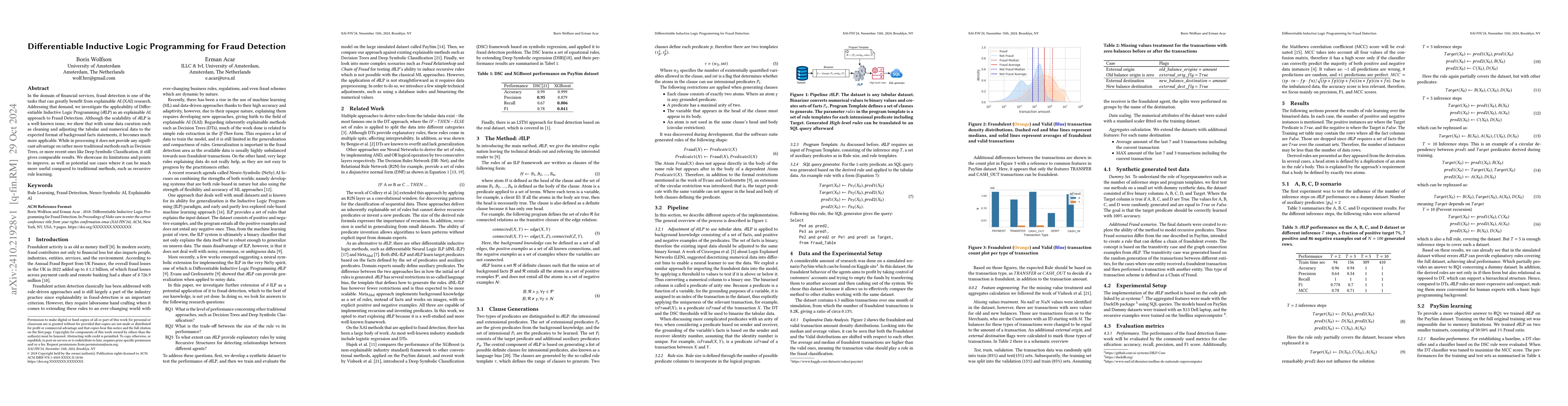

This paper investigates the application of Differentiable Inductive Logic Programming (DILP) for fraud detection, focusing on its explainability. The study explores DILP's performance on both synthetic dummy datasets and the PaySim dataset, addressing scalability issues through data curation.

Key Results

- DILP provides comparable results to traditional methods like Decision Trees and Deep Symbolic Classification in fraud detection, despite not offering significant performance advantages.

- DILP's rule learning is more expressive and compact than Decision Trees, offering hierarchical structure support.

- DILP successfully models recursive structures, deriving rules for fraud relationships and chains of fraud.

- DILP's performance on the PaySim dataset is inline with Deep Symbolic Classification, though it provides more interpretable rules.

- The method struggles with scalability due to memory consumption, especially when dealing with high-arity predicates and large datasets.

Significance

The research is significant as it explores explainable AI for fraud detection, a crucial area in finance. By providing interpretable rules, DILP can aid in understanding and trusting AI-driven fraud detection systems.

Technical Contribution

The paper presents an implementation of DILP tailored for fraud detection, demonstrating its ability to learn explainable rules from tabular data, and addresses scalability concerns through data curation.

Novelty

While inductive logic programming has been studied before, this work uniquely applies it to fraud detection, emphasizing explainability and recursive rule learning, and addresses scalability issues through data preprocessing techniques.

Limitations

- DILP's performance lags behind traditional methods like Decision Trees in certain aspects, particularly in handling large datasets efficiently.

- The method's reliance on binary predicates requires additional data transformation steps, adding complexity and computational overhead.

- Circular dependencies in generated rules pose a challenge, though the paper implements a removal mechanism for the target predicate.

Future Work

- Explore techniques to enhance DILP's scalability, possibly by optimizing predicate generation or employing more efficient data structures.

- Investigate hybrid models combining DILP with other machine learning approaches to leverage their respective strengths.

- Further research into the interpretability of DILP rules by human experts with varying logic programming backgrounds.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDifferentiable Inductive Logic Programming in High-Dimensional Space

David M. Cerna, Cezary Kaliszyk, Stanisław J. Purgał

No citations found for this paper.

Comments (0)