Summary

We consider a general class of diffusion-based models and show that, even in the absence of an Equivalent Local Martingale Measure, the financial market may still be viable, in the sense that strong forms of arbitrage are excluded and portfolio optimisation problems can be meaningfully solved. Relying partly on the recent literature, we provide necessary and sufficient conditions for market viability in terms of the market price of risk process and martingale deflators. Regardless of the existence of a martingale measure, we show that the financial market may still be complete and contingent claims can be valued under the original (real-world) probability measure, provided we use as numeraire the Growth-Optimal Portfolio.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

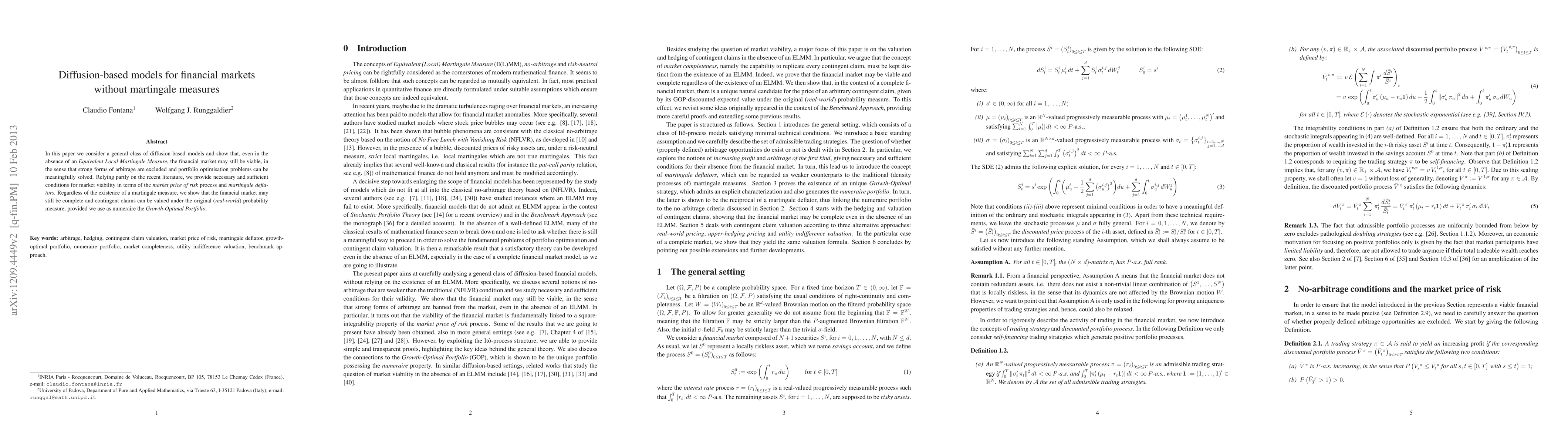

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)