Summary

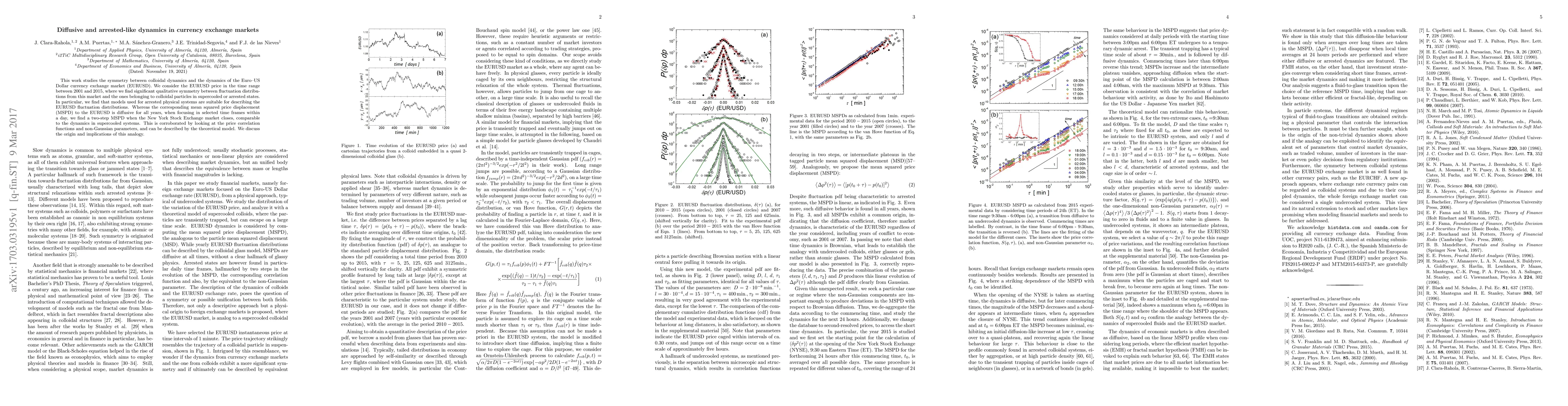

This work studies the symmetry between colloidal dynamics and the dynamics of the Euro--US Dollar currency exchange market (EURUSD). We consider the EURUSD price in the time range between 2001 and 2015, where we find significant qualitative symmetry between fluctuation distributions from this market and the ones belonging to colloidal particles in supercooled or arrested states. In particular, we find that models used for arrested physical systems are suitable for describing the EURUSD fluctuation distributions. Whereas the corresponding mean squared price displacement (MSPD) to the EURUSD is diffusive for all years, when focusing in selected time frames within a day, we find a two-step MSPD when the New York Stock Exchange market closes, comparable to the dynamics in supercooled systems. This is corroborated by looking at the price correlation functions and non-Gaussian parameters, and can be described by the theoretical model. We discuss the origin and implications of this analogy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExchange for Growth: Currency Dynamics in Emerging Markets

Shaunak Kulkarni, Rohan Ajay Dubey

| Title | Authors | Year | Actions |

|---|

Comments (0)