Authors

Summary

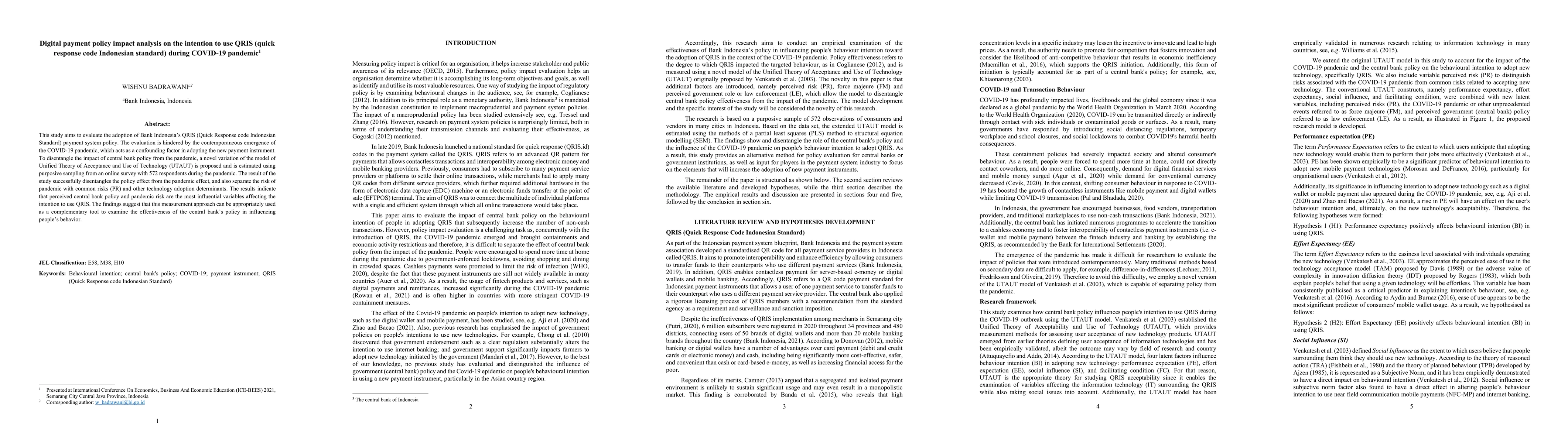

This study aims to evaluate the adoption of Bank Indonesia's QRIS (Quick Response code Indonesian Standard) payment system policy. The evaluation is hindered by the contemporaneous emergence of the COVID-19 pandemic, which acts as a confounding factor in adopting the new payment instrument. To disentangle the impact of central bank policy from the pandemic, a novel variation of the model of Unified Theory of Acceptance and Use of Technology (UTAUT) is proposed and is estimated using purposive sampling from an online survey with 572 respondents during the pandemic. The result of the study successfully disentangles the policy effect from the pandemic effect, and also separate the risk of pandemic with common risks (PR) and other technology adoption determinants. The results indicate that perceived central bank policy and pandemic risk are the most influential variables affecting the intention to use QRIS. The findings suggest that this measurement approach can be appropriately used as a complementary tool to examine the effectiveness of the central bank's policy in influencing people's behavior.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Impact of the COVID-19 Pandemic on Women's Contribution to Public Code

Davide Rossi, Stefano Zacchiroli, Théo Zimmermann et al.

A review of telehospice use during the COVID-19 pandemic.

Narvaez, Roison Andro, Abordo, Jonah, Casabona, April et al.

Response to the COVID-19 Pandemic: Physics Teaching in India

Ram Ramaswamy, Deepa Chari, V. Madhurima et al.

No citations found for this paper.

Comments (0)