Summary

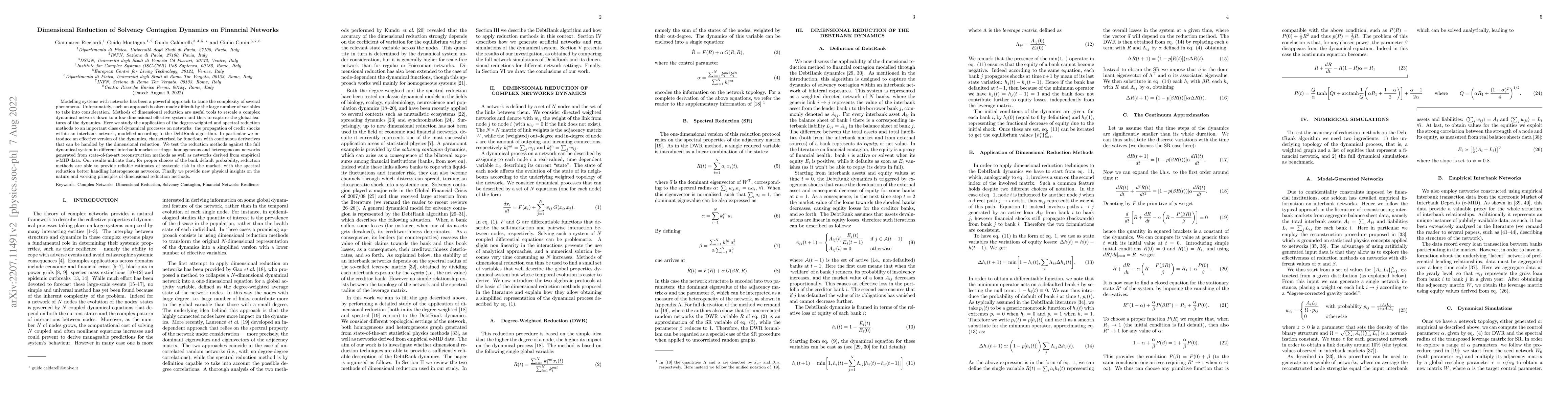

Modelling systems with networks has been a powerful approach to tame the complexity of several phenomena. Unfortunately, such an approach is often made difficult by the large number of variables to take into consideration. Methods of dimensional reduction are useful tools to rescale a complex dynamical network down to a low-dimensional effective system and thus to capture the global features of the dynamics. Here we study the application of the degree-weighted and spectral reduction methods to an important class of dynamical processes on networks: the propagation of credit shocks within an interbank network, modelled according to the DebtRank algorithm. In particular we introduce an effective version of the dynamics, characterised by functions with continuous derivatives that can be handled by the dimensional reduction. We test the reduction methods against the full dynamical system in different interbank market settings: homogeneous and heterogeneous networks generated from state-of-the-art reconstruction methods as well as networks derived from empirical e-MID data. Our results indicate that, for proper choices of the bank default probability, reduction methods are able to provide reliable estimates of systemic risk in the market, with the spectral reduction better handling heterogeneous networks. Finally we provide new physical insights on the nature and working principles of dimensional reduction methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStatistical Validation of Contagion Centrality in Financial Networks

Zachary Feinstein, Agathe Sadeghi

Measuring risk contagion in financial networks with CoVaR

Bikramjit Das, Vicky Fasen-Hartmann

| Title | Authors | Year | Actions |

|---|

Comments (0)