Summary

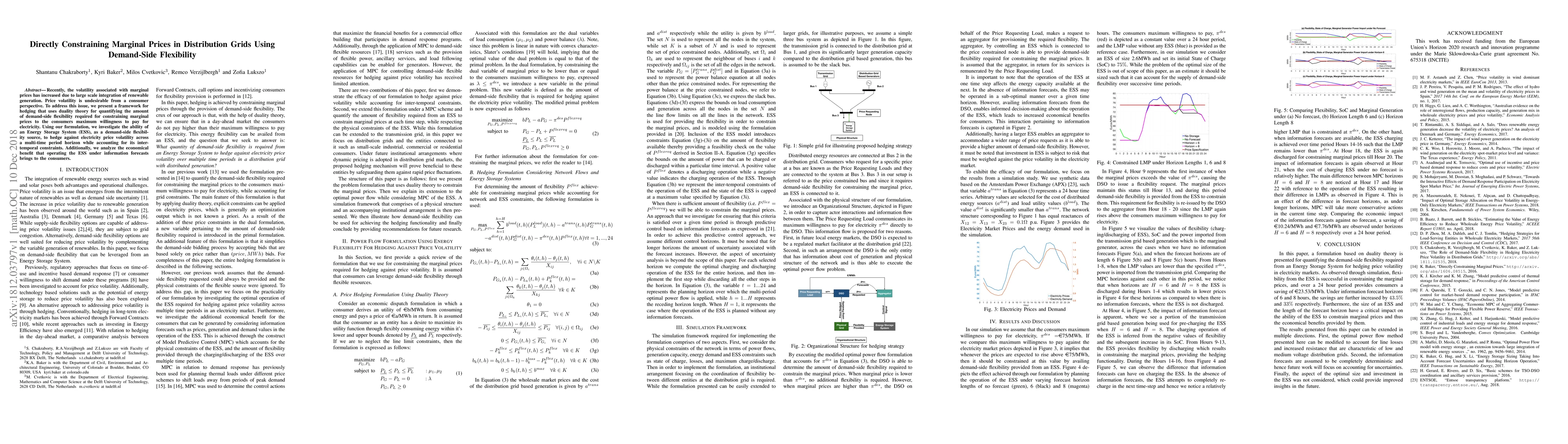

Recently, the volatility associated with marginal prices has increased due to large scale integration of renewable generation. Price volatility is undesirable from a consumer perspective. To address this issue, we present a framework for hedging that uses duality theory for quantifying the amount of demand-side flexibility required for constraining marginal prices to the consumers maximum willingness to pay for electricity. Using our formulation, we investigate the ability of an Energy Storage System (ESS), as a demand-side flexibility source, to hedge against electricity price volatility across a multi-time period horizon while accounting for its inter-temporal constraints. Additionally, we analyze the economical benefit that operating the ESS under information forecasts brings to the consumers.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEcosystem for Demand-side Flexibility Revisited: The Danish Solution

Jalal Kazempour, Henrik W. Bindner, Trygve Skjøtskift et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)