Authors

Summary

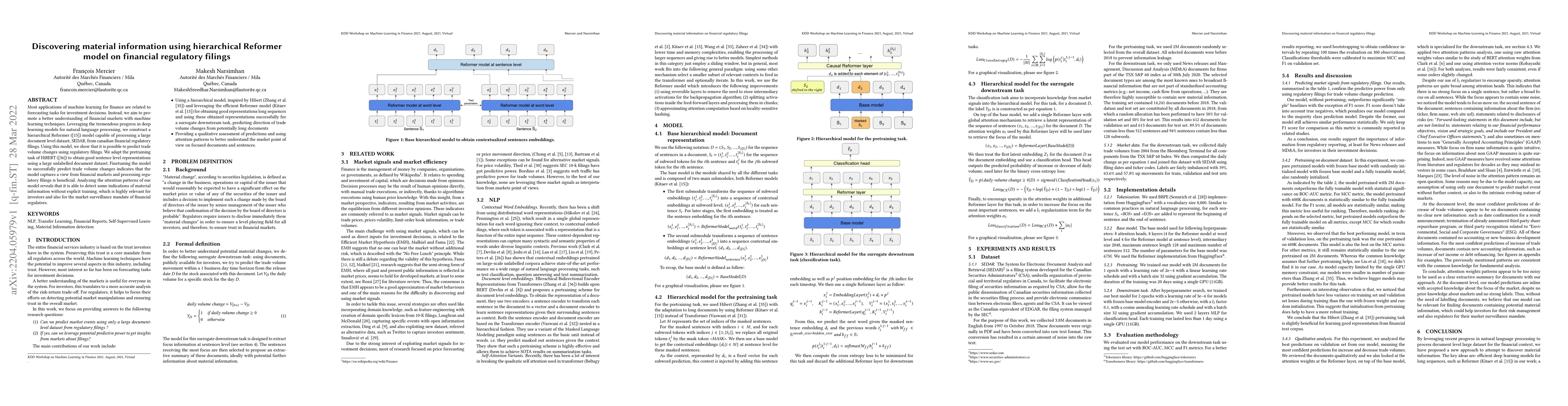

Most applications of machine learning for finance are related to forecasting tasks for investment decisions. Instead, we aim to promote a better understanding of financial markets with machine learning techniques. Leveraging the tremendous progress in deep learning models for natural language processing, we construct a hierarchical Reformer ([15]) model capable of processing a large document level dataset, SEDAR, from canadian financial regulatory filings. Using this model, we show that it is possible to predict trade volume changes using regulatory filings. We adapt the pretraining task of HiBERT ([36]) to obtain good sentence level representations using a large unlabelled document dataset. Finetuning the model to successfully predict trade volume changes indicates that the model captures a view from financial markets and processing regulatory filings is beneficial. Analyzing the attention patterns of our model reveals that it is able to detect some indications of material information without explicit training, which is highly relevant for investors and also for the market surveillance mandate of financial regulators.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinSage: A Multi-aspect RAG System for Financial Filings Question Answering

Yihong Wu, Xinyu Wang, Muzhi Li et al.

Large Language Model in Financial Regulatory Interpretation

Zachary Feinstein, Zhiyu Cao

Conversational Financial Information Retrieval Model (ConFIRM)

Tingting Li, Stephen Choi, William Gazeley et al.

Discovering Hierarchical Process Models: an Approach Based on Events Clustering

Irina A. Lomazova, Antonina K. Begicheva, Roman A. Nesterov

No citations found for this paper.

Comments (0)