Summary

This paper shows that in suitable markets, even with out-of-equilibrium trade allowed, a simple price update rule leads to rapid convergence toward the equilibrium. In particular, this paper considers a Fisher market repeated over an unbounded number of time steps, with the addition of finite sized warehouses to enable non-equilibrium trade. The main result is that suitable tatonnement style price updates lead to convergence in a significant subset of markets satisfying the Weak Gross Substitutes property. Throughout this process the warehouse are always able to store or meet demand imbalances (the needed capacity depends on the initial imbalances). Finally, our price update rule is robust in a variety of regards: 1. The updates for each good depend only on information about that good (its current price, its excess demand since its last update) and occur asynchronously from updates to other prices. 2. The process is resilient to error in the excess demand data. 3. Likewise, the process is resilient to discreteness, i.e. a limit to divisibility, both of goods and money.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

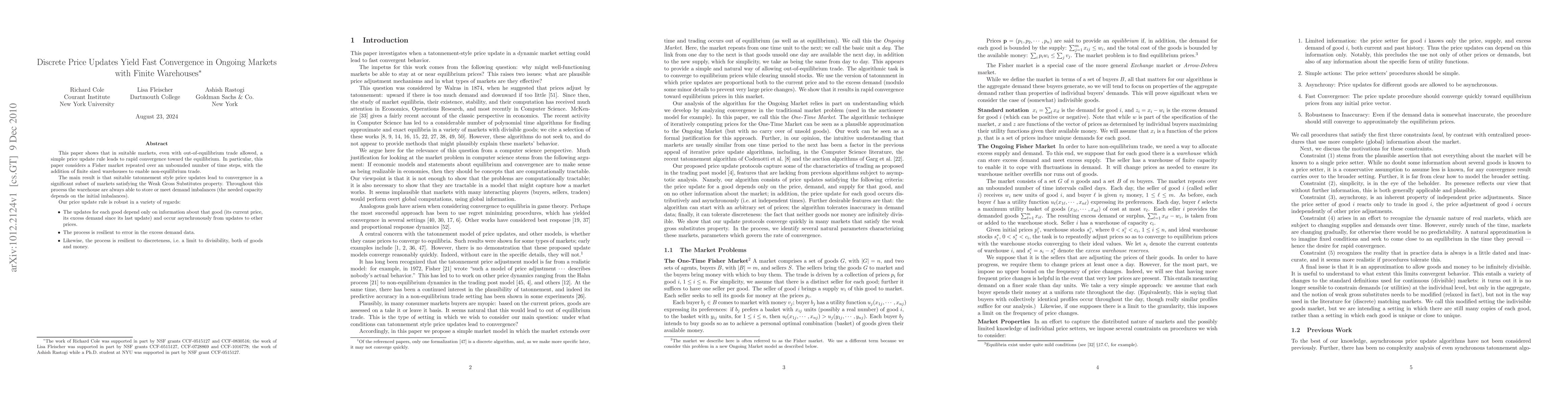

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPrice Interpretability of Prediction Markets: A Convergence Analysis

Jianjun Gao, Zizhuo Wang, Dian Yu et al.

Accelerated Price Adjustment for Fisher Markets with Exact Recovery of Competitive Equilibrium

Anthony Man-Cho So, He Chen, Chonghe Jiang

| Title | Authors | Year | Actions |

|---|

Comments (0)