Authors

Summary

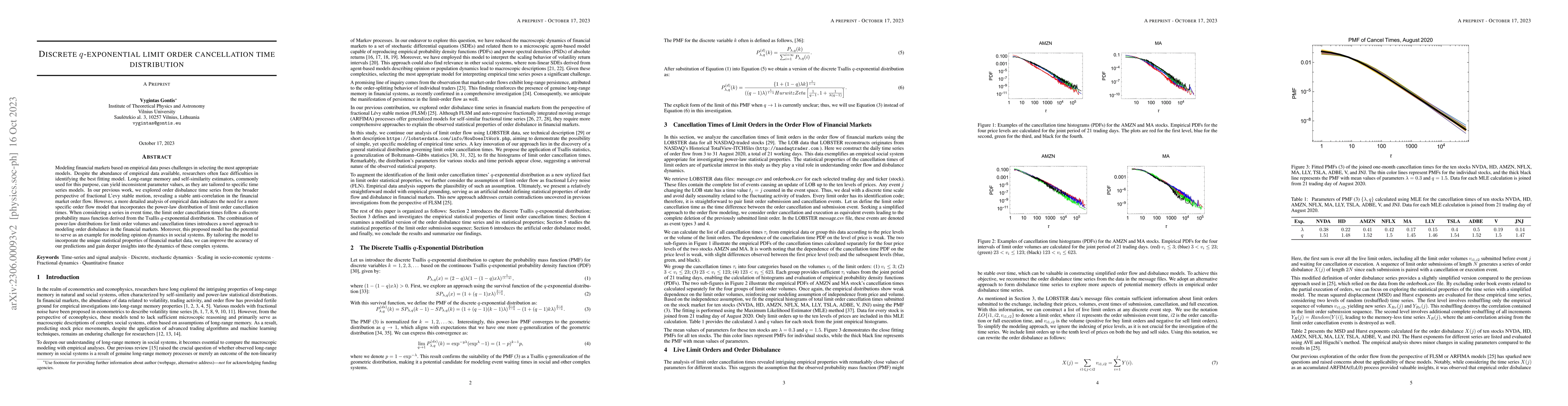

Modeling financial markets based on empirical data poses challenges in selecting the most appropriate models. Despite the abundance of empirical data available, researchers often face difficulties in identifying the best-fitting model. Long-range memory and self-similarity estimators, commonly used for this purpose, can yield inconsistent parameter values, as they are tailored to specific time series models. In our previous work, we explored order disbalance time series from the broader perspective of fractional L'{e}vy stable motion, revealing a stable anti-correlation in the financial market order flow. However, a more detailed analysis of empirical data indicates the need for a more specific order flow model that incorporates the power-law distribution of limit order cancellation times. When considering a series in event time, the limit order cancellation times follow a discrete probability mass function derived from the Tsallis q-exponential distribution. The combination of power-law distributions for limit order volumes and cancellation times introduces a novel approach to modeling order disbalance in the financial markets. Moreover, this proposed model has the potential to serve as an example for modeling opinion dynamics in social systems. By tailoring the model to incorporate the unique statistical properties of financial market data, we can improve the accuracy of our predictions and gain deeper insights into the dynamics of these complex systems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRandom networks with q-exponential degree distribution

Hans J. Herrmann, Cesar I. N. Sampaio Filho, José S. Andrade Jr et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)