Authors

Summary

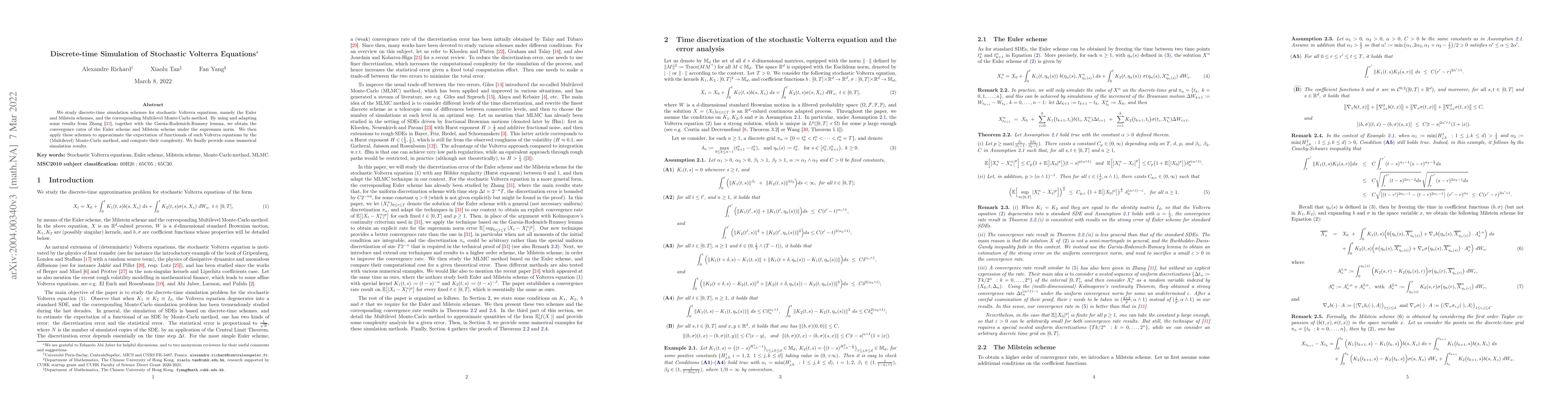

We study discrete-time simulation schemes for stochastic Volterra equations, namely the Euler and Milstein schemes, and the corresponding Multi-Level Monte-Carlo method. By using and adapting some results from Zhang [22], together with the Garsia-Rodemich-Rumsey lemma, we obtain the convergence rates of the Euler scheme and Milstein scheme under the supremum norm. We then apply these schemes to approximate the expectation of functionals of such Volterra equations by the (Multi-Level) Monte-Carlo method, and compute their complexity.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)