Summary

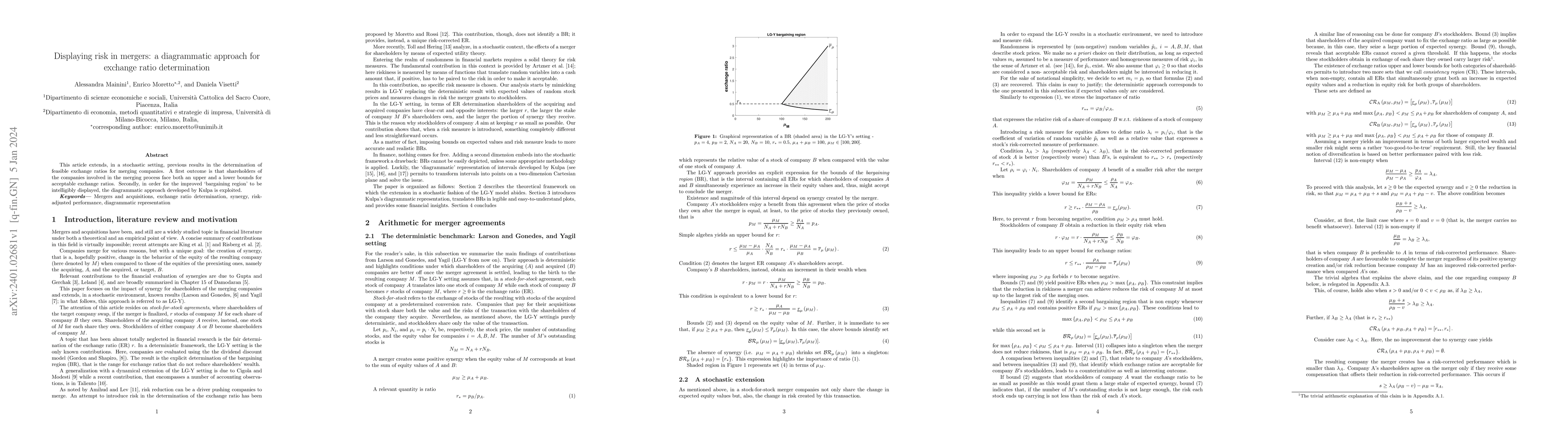

This article extends, in a stochastic setting, previous results in the determination of feasible exchange ratios for merging companies. A first outcome is that shareholders of the companies involved in the merging process face both an upper and a lower bounds for acceptable exchange ratios. Secondly, in order for the improved `bargaining region' to be intelligibly displayed, the diagrammatic approach developed by Kulpa is exploited.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)