Summary

Ponzi schemes are financial frauds which lure users under the promise of high profits. Actually, users are repaid only with the investments of new users joining the scheme: consequently, a Ponzi scheme implodes soon after users stop joining it. Originated in the offline world 150 years ago, Ponzi schemes have since then migrated to the digital world, approaching first the Web, and more recently hanging over cryptocurrencies like Bitcoin. Smart contract platforms like Ethereum have provided a new opportunity for scammers, who have now the possibility of creating "trustworthy" frauds that still make users lose money, but at least are guaranteed to execute "correctly". We present a comprehensive survey of Ponzi schemes on Ethereum, analysing their behaviour and their impact from various viewpoints.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

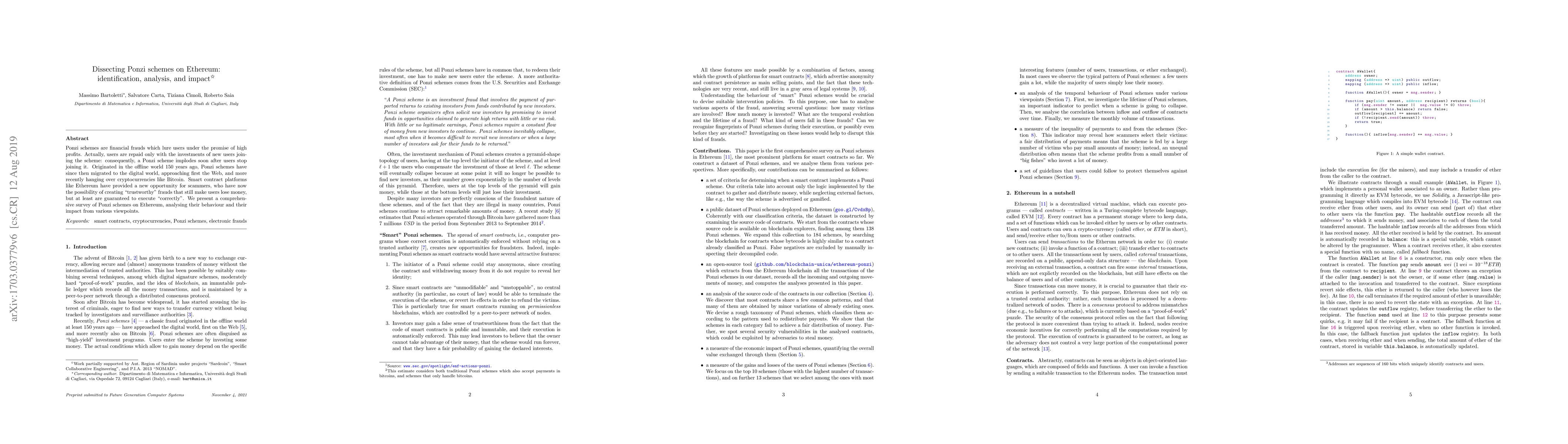

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCode Will Tell: Visual Identification of Ponzi Schemes on Ethereum

Yong Wang, Min Zhu, Feida Zhu et al.

SourceP: Detecting Ponzi Schemes on Ethereum with Source Code

Keting Yin, Pengcheng Lu, Liang Cai

Explainable Ponzi Schemes Detection on Ethereum

Letterio Galletta, Fabio Pinelli

Dual-channel Early Warning Framework for Ethereum Ponzi Schemes

Qi Xuan, Jiajun Zhou, Shanqing Yu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)