Authors

Summary

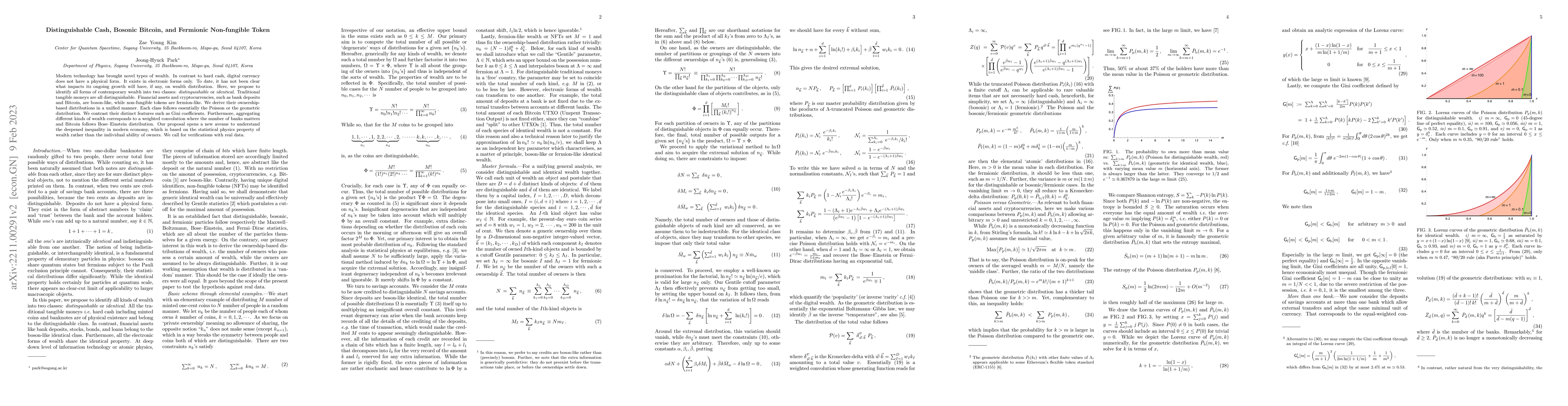

Modern technology has brought novel types of wealth. In contrast to hard cashes, digital currencies do not have a physical form. They exist in electronic forms only. Yet, it has not been clear what impacts their ongoing growth will make, if any, on wealth distribution. Here we propose to identify all forms of contemporary wealth into two classes: 'distinguishable' or 'identical'. Traditional tangible moneys are all distinguishable. Financial assets and cryptocurrencies, such as bank deposits and Bitcoin, are boson-like, while non-fungible tokens are fermion-like. We derive their ownership-based distributions in a unified manner. Each class follows essentially the Poisson or the geometric distribution. We contrast their distinct features such as Gini coefficients. Further, aggregating different kinds of wealth corresponds to a weighted convolution where the number of banks matters and Bitcoin follows Bose-Einstein distribution. Our proposal opens a new avenue to understand the deepened inequality in modern economy, which is based on the statistical physics property of wealth rather than the individual ability of owners. We call for verifications with real data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNon-fungible token transactions: data and challenges

David S. Matteson, Sven Serneels, Jason B. Cho

| Title | Authors | Year | Actions |

|---|

Comments (0)