Authors

Summary

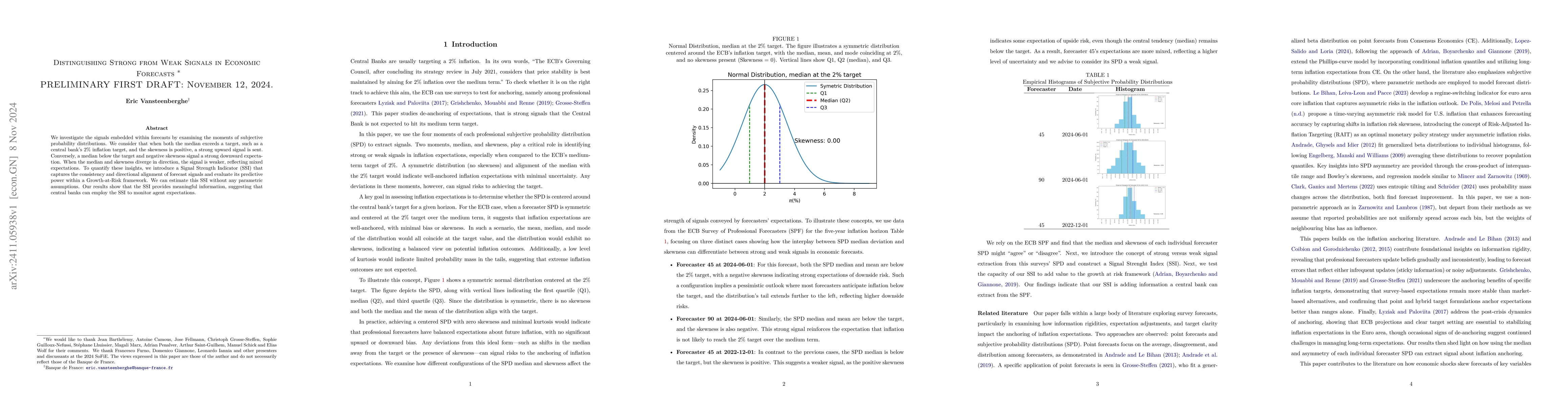

We analyze the information embedded in forecasts by examining the moments of subjective probability distributions. Specifically, we propose that a forecast conveys a strong upward signal when the median exceeds a target, such as a central bank's 2% inflation threshold, coupled with positive skewness. Conversely, a median below the target with negative skewness signals strong downward expectations. In cases where the median and skewness diverge, the signal weakens, indicating mixed expectations. To formalize these insights, we develop a Signal Strength Indicator (SSI) that quantifies the consistency and directional alignment of forecast signals, assessing its predictive power within a Growth-at-Risk framework. Importantly, the SSI can be estimated without relying on parametric assumptions. Our findings indicate that the SSI offers valuable insights, suggesting it could serve as a practical tool for central banks to monitor expectations in real time.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOverinference from Weak Signals and Underinference from Strong Signals

Ned Augenblick, Eben Lazarus, Michael Thaler

Prediction intervals for economic fixed-event forecasts

Fabian Krüger, Hendrik Plett

No citations found for this paper.

Comments (0)