Summary

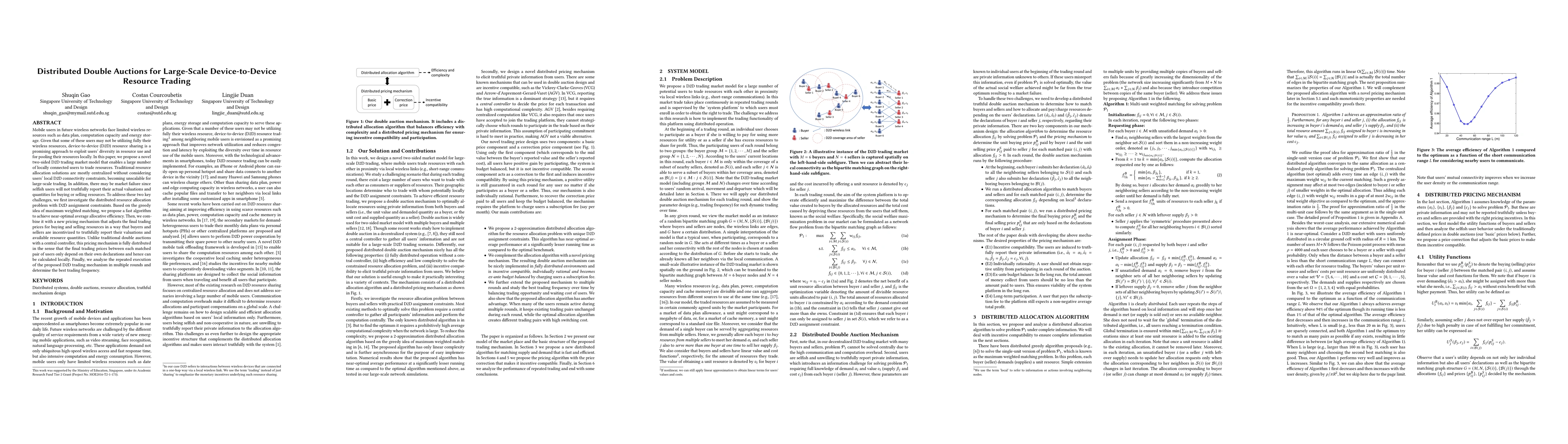

Mobile users in future wireless networks face limited wireless resources such as data plan, computation capacity and energy storage. Given that some of these users may not be utilizing fully their wireless resources, device-to-device (D2D) resource sharing is a promising approach to exploit users' diversity in resource use and for pooling their resources locally. In this paper, we propose a novel two-sided D2D trading market model that enables a large number of locally connected users to trade resources. Traditional resource allocation solutions are mostly centralized without considering users' local D2D connectivity constraints, becoming unscalable for large-scale trading. In addition, there may be market failure since selfish users will not truthfully report their actual valuations and quantities for buying or selling resources. To address these two key challenges, we first investigate the distributed resource allocation problem with D2D assignment constraints. Based on the greedy idea of maximum weighted matching, we propose a fast algorithm to achieve near-optimal average allocative efficiency. Then, we combine it with a new pricing mechanism that adjusts the final trading prices for buying and selling resources in a way that buyers and sellers are incentivized to truthfully report their valuations and available resource quantities. Unlike traditional double auctions with a central controller, this pricing mechanism is fully distributed in the sense that the final trading prices between each matched pair of users only depend on their own declarations and hence can be calculated locally. Finally, we analyze the repeated execution of the proposed D2D trading mechanism in multiple rounds and determine the best trading frequency.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)