Summary

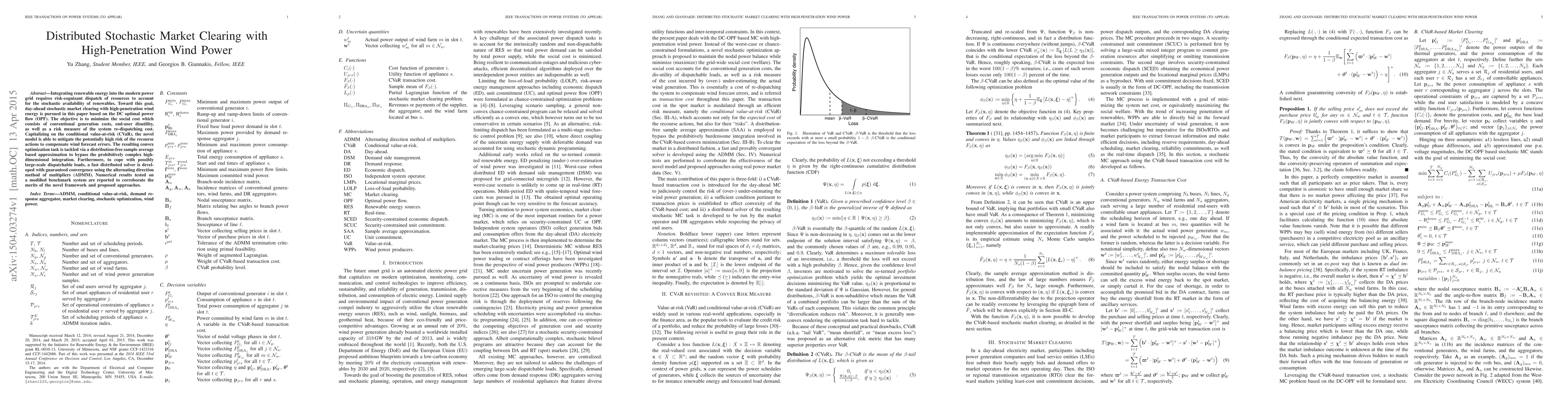

Integrating renewable energy into the modern power grid requires risk-cognizant dispatch of resources to account for the stochastic availability of renewables. Toward this goal, day-ahead stochastic market clearing with high-penetration wind energy is pursued in this paper based on the DC optimal power flow (OPF). The objective is to minimize the social cost which consists of conventional generation costs, end-user disutility, as well as a risk measure of the system re-dispatching cost. Capitalizing on the conditional value-at-risk (CVaR), the novel model is able to mitigate the potentially high risk of the recourse actions to compensate wind forecast errors. The resulting convex optimization task is tackled via a distribution-free sample average based approximation to bypass the prohibitively complex high-dimensional integration. Furthermore, to cope with possibly large-scale dispatchable loads, a fast distributed solver is developed with guaranteed convergence using the alternating direction method of multipliers (ADMM). Numerical results tested on a modified benchmark system are reported to corroborate the merits of the novel framework and proposed approaches.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)