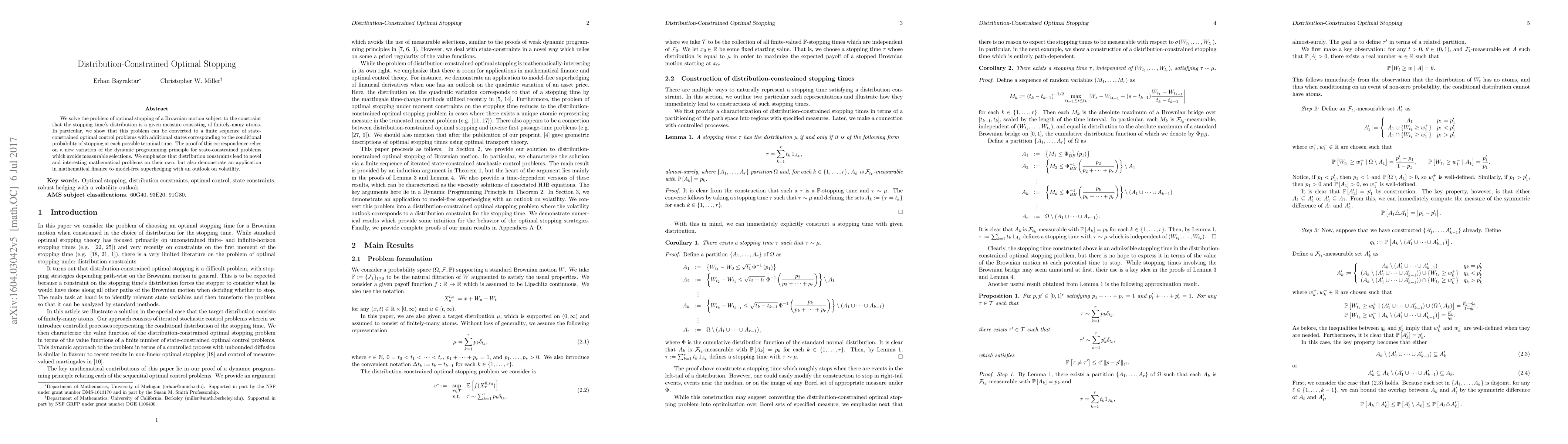

Summary

We solve the problem of optimal stopping of a Brownian motion subject to the constraint that the stopping time's distribution is a given measure consisting of finitely-many atoms. In particular, we show that this problem can be converted to a finite sequence of state-constrained optimal control problems with additional states corresponding to the conditional probability of stopping at each possible terminal time. The proof of this correspondence relies on a new variation of the dynamic programming principle for state-constrained problems which avoids measurable selection. We emphasize that distribution constraints lead to novel and interesting mathematical problems on their own, but also demonstrate an application in mathematical finance to model-free superhedging with an outlook on volatility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConstrained optimal stopping under a regime-switching model

Takuji Arai, Masahiko Takenaka

| Title | Authors | Year | Actions |

|---|

Comments (0)