Authors

Summary

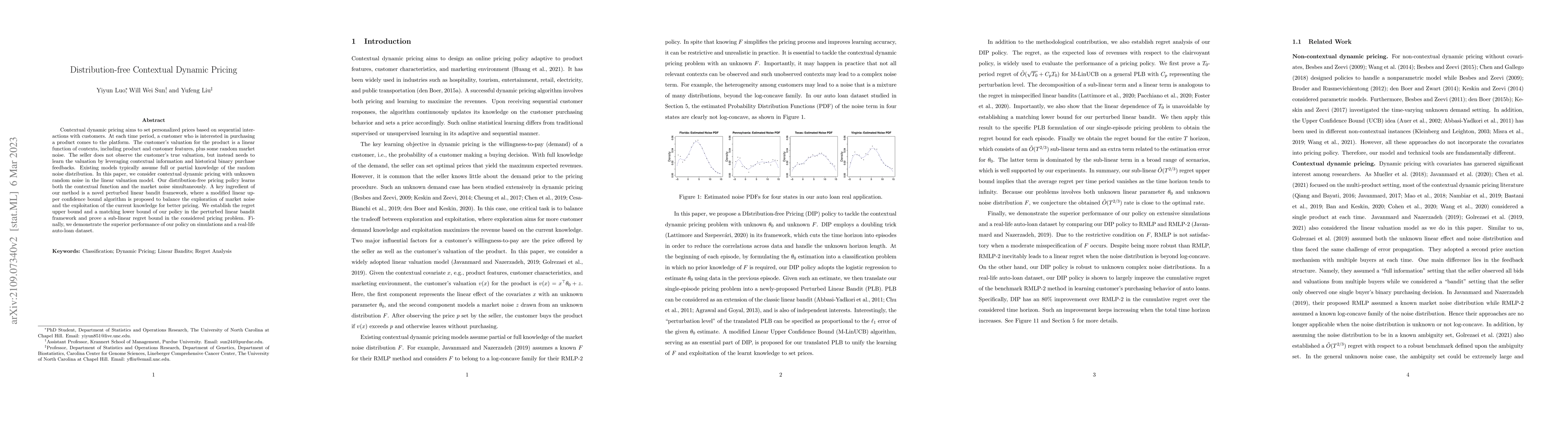

Contextual dynamic pricing aims to set personalized prices based on sequential interactions with customers. At each time period, a customer who is interested in purchasing a product comes to the platform. The customer's valuation for the product is a linear function of contexts, including product and customer features, plus some random market noise. The seller does not observe the customer's true valuation, but instead needs to learn the valuation by leveraging contextual information and historical binary purchase feedbacks. Existing models typically assume full or partial knowledge of the random noise distribution. In this paper, we consider contextual dynamic pricing with unknown random noise in the valuation model. Our distribution-free pricing policy learns both the contextual function and the market noise simultaneously. A key ingredient of our method is a novel perturbed linear bandit framework, where a modified linear upper confidence bound algorithm is proposed to balance the exploration of market noise and the exploitation of the current knowledge for better pricing. We establish the regret upper bound and a matching lower bound of our policy in the perturbed linear bandit framework and prove a sub-linear regret bound in the considered pricing problem. Finally, we demonstrate the superior performance of our policy on simulations and a real-life auto-loan dataset.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLocalized exploration in contextual dynamic pricing achieves dimension-free regret

Jianqing Fan, Kaizheng Wang, Yaqi Duan et al.

Improved Algorithms for Contextual Dynamic Pricing

Vianney Perchet, Matilde Tullii, Solenne Gaucher et al.

Contextual Dynamic Pricing with Strategic Buyers

Will Wei Sun, Zhuoran Yang, Zhaoran Wang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)