Summary

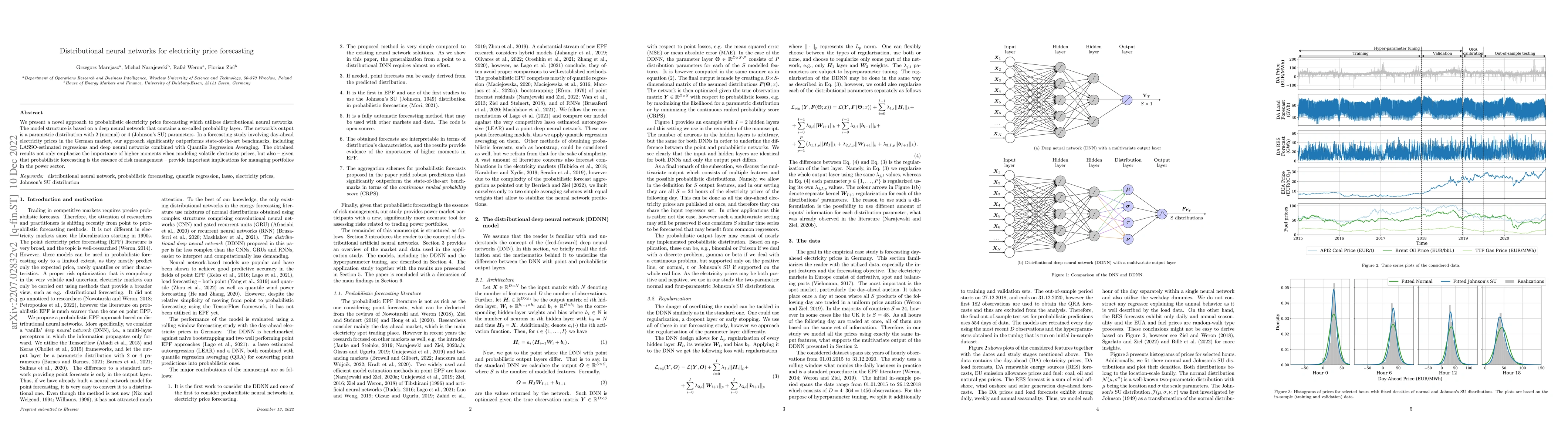

We present a novel approach to probabilistic electricity price forecasting which utilizes distributional neural networks. The model structure is based on a deep neural network that contains a so-called probability layer. The network's output is a parametric distribution with 2 (normal) or 4 (Johnson's SU) parameters. In a forecasting study involving day-ahead electricity prices in the German market, our approach significantly outperforms state-of-the-art benchmarks, including LASSO-estimated regressions and deep neural networks combined with Quantile Regression Averaging. The obtained results not only emphasize the importance of higher moments when modeling volatile electricity prices, but also -- given that probabilistic forecasting is the essence of risk management -- provide important implications for managing portfolios in the power sector.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFrom Distributional to Quantile Neural Basis Models: the case of Electricity Price Forecasting

Alessandro Brusaferri, Andrea Ballarino, Danial Ramin

Transfer Learning for Electricity Price Forecasting

Ilkay Oksuz, Salih Gunduz, Umut Ugurlu

| Title | Authors | Year | Actions |

|---|

Comments (0)