Authors

Summary

We reinterpret and propose a framework for pricing path-dependent financial derivatives by estimating the full distribution of payoffs using Distributional Reinforcement Learning (DistRL). Unlike traditional methods that focus on expected option value, our approach models the entire conditional distribution of payoffs, allowing for risk-aware pricing, tail-risk estimation, and enhanced uncertainty quantification. We demonstrate the efficacy of this method on Asian options, using quantile-based value function approximators.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

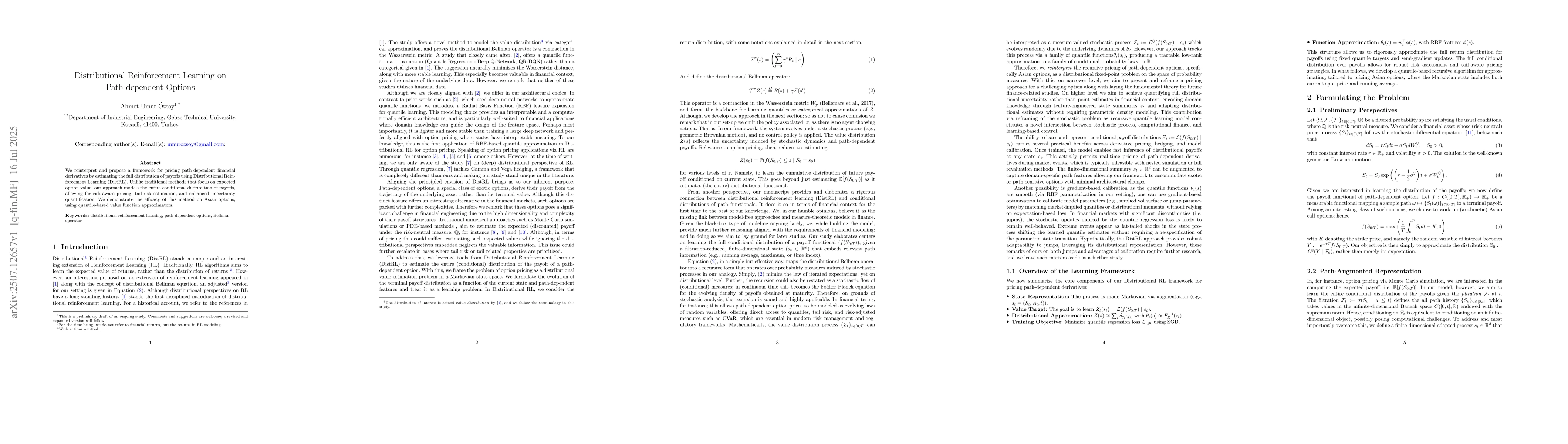

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)