Authors

Summary

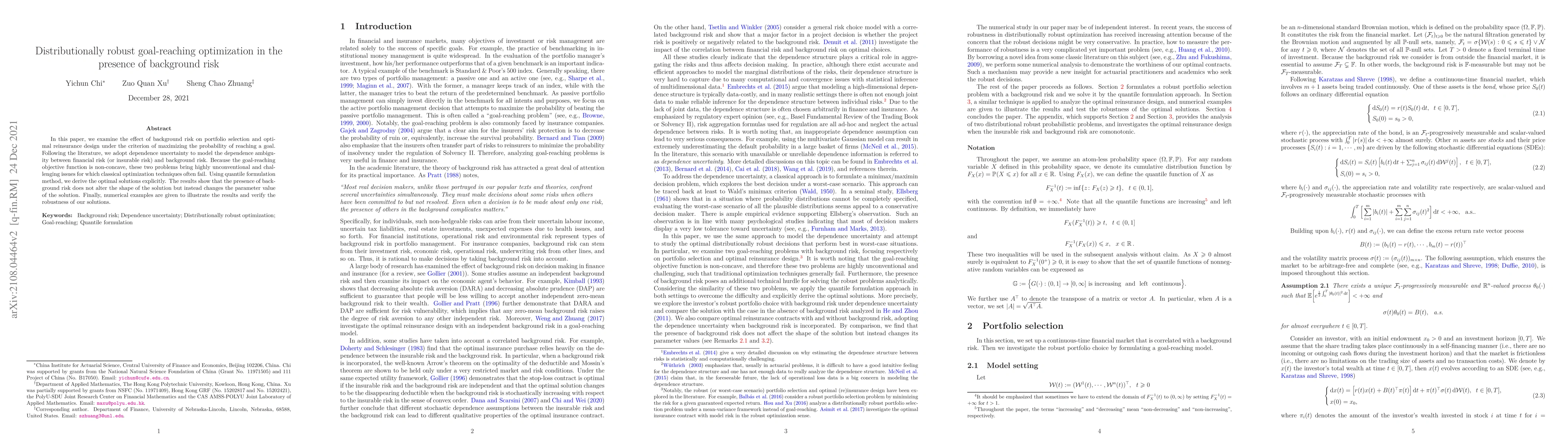

In this paper, we examine the effect of background risk on portfolio selection and optimal reinsurance design under the criterion of maximizing the probability of reaching a goal. Following the literature, we adopt dependence uncertainty to model the dependence ambiguity between financial risk (or insurable risk) and background risk. Because the goal-reaching objective function is non-concave, these two problems bring highly unconventional and challenging issues for which classical optimization techniques often fail. Using quantile formulation method, we derive the optimal solutions explicitly. The results show that the presence of background risk does not alter the shape of the solution but instead changes the parameter value of the solution. Finally, numerical examples are given to illustrate the results and verify the robustness of our solutions.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper uses a quantile formulation method to derive optimal solutions explicitly for goal-reaching optimization problems in the presence of background risk, addressing the non-concavity of the objective function.

Key Results

- The presence of background risk does not alter the shape of the optimal solution but changes its parameter value.

- Optimal solutions for portfolio selection and reinsurance design are derived under dependence uncertainty, modeling ambiguity in the dependence structure between financial and background risks.

- Numerical examples illustrate the results and verify the robustness of the solutions.

Significance

This research is significant as it provides a framework for handling dependence ambiguity in financial and insurance contexts, offering practical solutions for portfolio selection and reinsurance design under goal-reaching objectives.

Technical Contribution

The paper introduces a quantile formulation method to explicitly derive optimal solutions for goal-reaching optimization problems under background risk, providing a novel approach to handle non-concave objective functions in portfolio and reinsurance optimization.

Novelty

The method of using quantile formulation to derive explicit optimal solutions in the presence of background risk is novel, offering a practical solution to the challenges posed by non-concave objective functions in financial and insurance optimization problems.

Limitations

- The paper assumes dependence uncertainty can be modeled using a specific approach (dependence ambiguity).

- The analysis is limited to continuous probability distribution functions and may not generalize to discrete or more complex distributions.

Future Work

- Further research could explore the application of this methodology to other financial and insurance problems.

- Investigating the impact of different types of background risk distributions on optimal solutions could be valuable.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDistributionally Robust Performative Optimization

Zhuangzhuang Jia, Yijie Wang, Roy Dong et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)