Authors

Summary

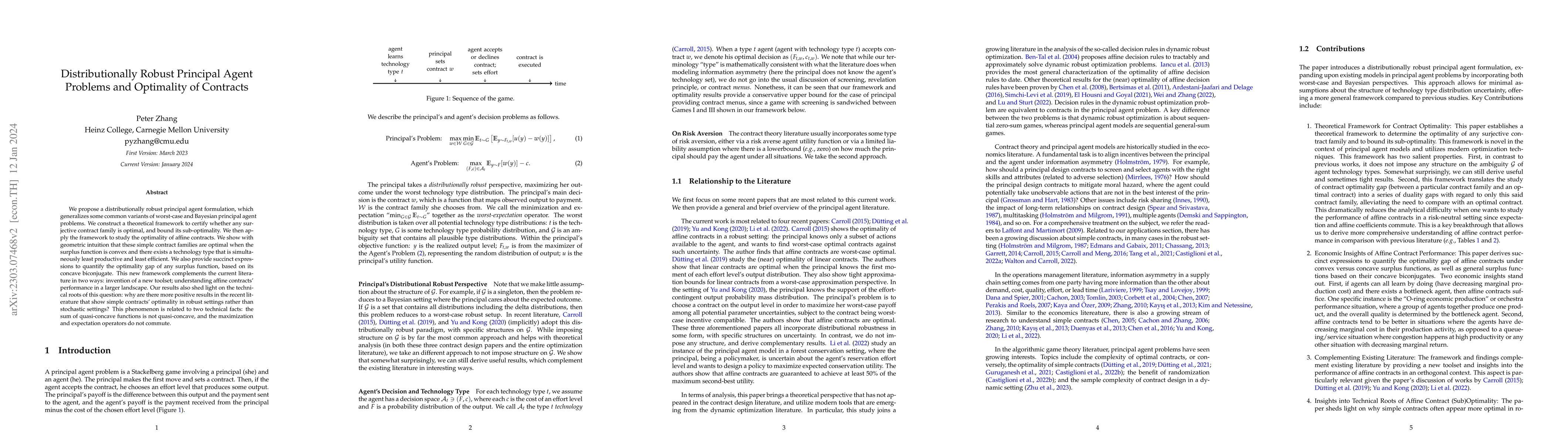

We propose a distributionally robust principal agent formulation, which generalizes some common variants of worst-case and Bayesian principal agent problems. We construct a theoretical framework to certify whether any surjective contract family is optimal, and bound its sub-optimality. We then apply the framework to study the optimality of affine contracts. We show with geometric intuition that these simple contract families are optimal when the surplus function is convex and there exists a technology type that is simultaneously least productive and least efficient. We also provide succinct expressions to quantify the optimality gap of any surplus function, based on its concave biconjugate. This new framework complements the current literature in two ways: invention of a new toolset; understanding affine contracts' performance in a larger landscape. Our results also shed light on the technical roots of this question: why are there more positive results in the recent literature that show simple contracts' optimality in robust settings rather than stochastic settings? This phenomenon is related to two technical facts: the sum of quasi-concave functions is not quasi-concave, and the maximization and expectation operators do not commute.

AI Key Findings

Generated Sep 07, 2025

Methodology

The paper proposes a distributionally robust principal-agent formulation, generalizing common variants of worst-case and Bayesian problems. It constructs a theoretical framework to certify optimality of surjective contract families and bounds their sub-optimality, focusing on affine contracts.

Key Results

- The framework certifies optimality of surjective contract families and bounds their sub-optimality.

- Affine contracts are optimal when the surplus function is convex and there exists a technology type that is simultaneously least productive and least efficient.

- Succinct expressions quantify the optimality gap of any surplus function based on its concave biconjugate.

- The new framework complements existing literature by providing a toolset for understanding affine contracts' performance in a broader landscape.

- The results shed light on why simple contracts are more likely to be optimal in robust settings compared to stochastic settings, due to the non-commutativity of maximization and expectation operators.

Significance

This research is significant as it develops a distributionally robust principal-agent framework that generalizes existing formulations, providing a theoretical toolset for analyzing contract optimality in various uncertainty settings.

Technical Contribution

The paper introduces a distributionally robust principal-agent formulation and a theoretical framework to certify optimality of surjective contract families, providing bounds on their sub-optimality.

Novelty

This work stands out by generalizing common variants of worst-case and Bayesian principal-agent problems into a unified distributionally robust formulation, offering new insights into contract optimality and the performance of affine contracts.

Limitations

- The analysis primarily focuses on affine and linear contracts, which may limit the applicability to more complex contract structures.

- The findings are based on specific conditions (e.g., convexity of surplus functions), which might not generalize to all practical scenarios.

Future Work

- Investigate the optimality of more complex contract structures beyond affine and linear families.

- Explore the implications of this framework for practical applications in economics and management.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRandom horizon principal-agent problems

Yiqing Lin, Nizar Touzi, Zhenjie Ren et al.

Fair Contracts in Principal-Agent Games with Heterogeneous Types

Christos Dimitrakakis, Victor Villin, Jakub Tłuczek

A new approach to principal-agent problems with volatility control

Emma Hubert, Alessandro Chiusolo

No citations found for this paper.

Comments (0)