Authors

Summary

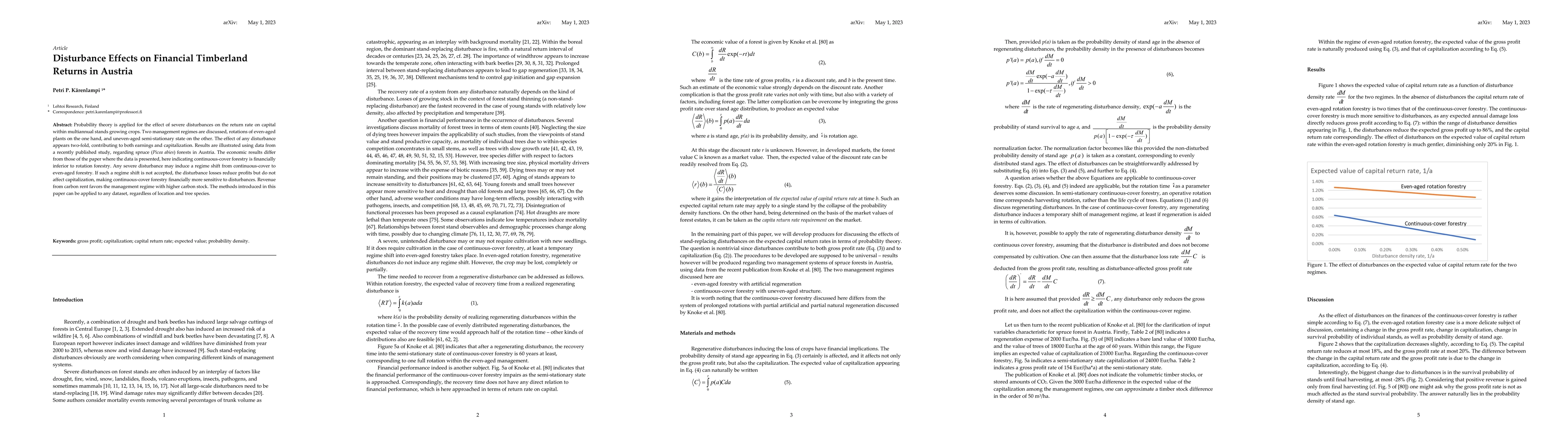

Probability theory is applied for the effect of severe disturbances on the return rate on capital within multiannual stands growing crops. Two management regimes are discussed, rotations of even-aged plants on the one hand, and uneven-aged semi-stationary state on the other. The effect of any disturbance appears two-fold, contributing to both earnings and capitalization. Results are illustrated using data from a recently published study, regarding spruce (Picea abies) forests in Austria. The economic results differ from those of the paper where the data is presented, here indicating continuous-cover forestry is financially inferior to rotation forestry. Any severe disturbance may induce a regime shift from continuous-cover to even-aged forestry. If such a regime shift is not accepted, the disturbance losses reduce profits but do not affect capitalization, making continuous-cover forestry financially more sensitive to disturbances. Revenue from carbon rent favors the management regime with higher carbon stock. The methods introduced in this paper can be applied to any dataset, regardless of location and tree species.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)