Authors

Summary

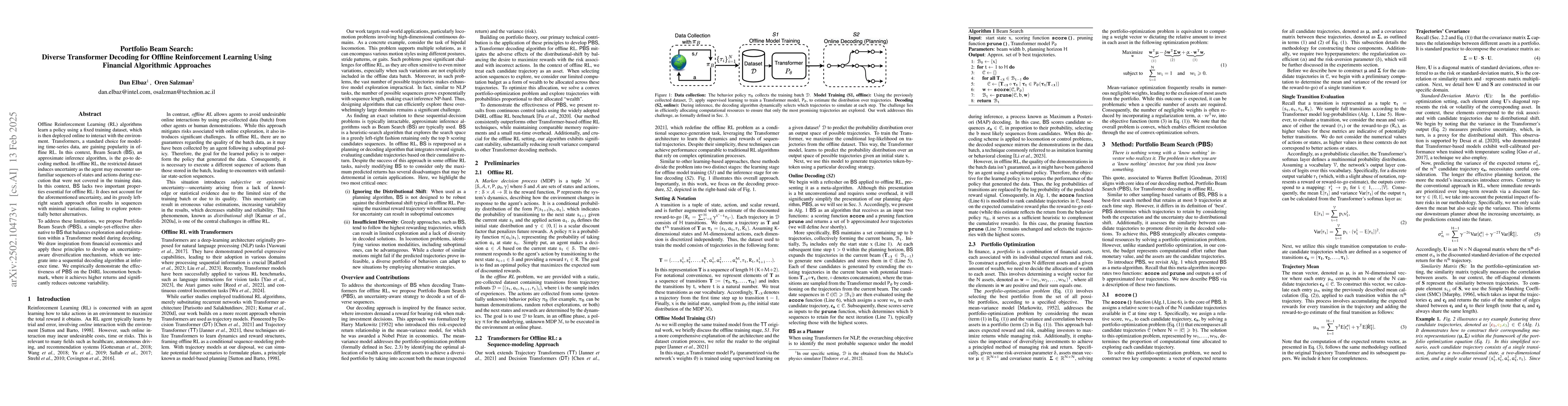

Offline Reinforcement Learning (RL) algorithms learn a policy using a fixed training dataset, which is then deployed online to interact with the environment and make decisions. Transformers, a standard choice for modeling time-series data, are gaining popularity in offline RL. In this context, Beam Search (BS), an approximate inference algorithm, is the go-to decoding method. Offline RL eliminates the need for costly or risky online data collection. However, the restricted dataset induces uncertainty as the agent may encounter unfamiliar sequences of states and actions during execution that were not covered in the training data. In this context, BS lacks two important properties essential for offline RL: It does not account for the aforementioned uncertainty, and its greedy left-right search approach often results in sequences with minimal variations, failing to explore potentially better alternatives. To address these limitations, we propose Portfolio Beam Search (PBS), a simple-yet-effective alternative to BS that balances exploration and exploitation within a Transformer model during decoding. We draw inspiration from financial economics and apply these principles to develop an uncertainty-aware diversification mechanism, which we integrate into a sequential decoding algorithm at inference time. We empirically demonstrate the effectiveness of PBS on the D4RL locomotion benchmark, where it achieves higher returns and significantly reduces outcome variability.

AI Key Findings

Generated Jun 11, 2025

Methodology

The research proposes Portfolio Beam Search (PBS), a decoding method for Transformer models in offline Reinforcement Learning (RL), inspired by financial portfolio optimization principles to address uncertainty and lack of diversity in Beam Search (BS).

Key Results

- PBS outperforms baseline methods (TT, DT, BooT, EDT) on D4RL locomotion tasks, achieving higher returns and significantly reducing outcome variability.

- PBS reduces standard deviation by more than 60% compared to TT, demonstrating more stable behavior in offline RL settings.

Significance

This research is significant as it introduces a novel decoding algorithm (PBS) that enhances the quality of generated sequences in offline RL, crucial for high-stakes applications where errors can have significant consequences.

Technical Contribution

PBS introduces a diversification mechanism inspired by financial portfolio optimization to balance exploration and exploitation in Transformer decoding for offline RL, addressing the limitations of Beam Search in handling uncertainty and lack of diversity.

Novelty

PBS is novel as it adapts concepts from financial economics to RL decoding, providing a structured approach to risk control and encouraging diversity in trajectory selection, which is essential for robust offline RL performance.

Limitations

- The study focuses on offline RL and does not explore online RL scenarios.

- The effectiveness of PBS is evaluated on specific locomotion tasks; its generalizability to other domains remains to be explored.

Future Work

- Investigate the applicability of PBS in other RL domains beyond locomotion tasks.

- Explore the integration of PBS with various Transformer architectures for broader applicability.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBootstrapped Transformer for Offline Reinforcement Learning

Weinan Zhang, Dongsheng Li, Xufang Luo et al.

Contextual Transformer for Offline Meta Reinforcement Learning

Jun Wang, Yaodong Yang, Ye Li et al.

Q-Transformer: Scalable Offline Reinforcement Learning via Autoregressive Q-Functions

Aviral Kumar, Yao Lu, Sergey Levine et al.

Causal Decision Transformer for Recommender Systems via Offline Reinforcement Learning

Lina Yao, Siyu Wang, Xiaocong Chen et al.

No citations found for this paper.

Comments (0)