Summary

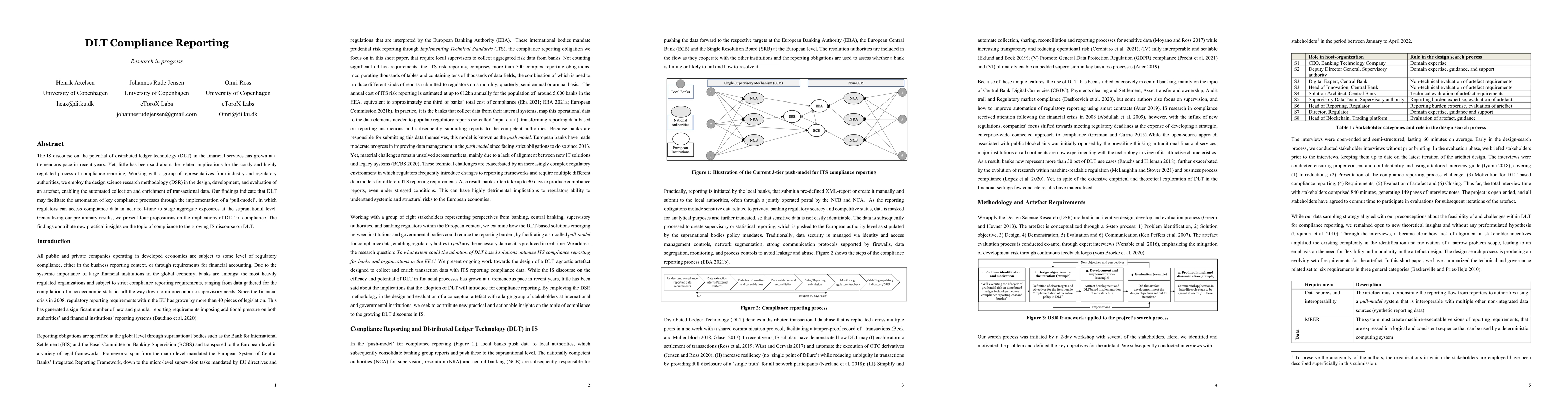

The IS discourse on the potential of distributed ledger technology (DLT) in the financial services has grown at a tremendous pace in recent years. Yet, little has been said about the related implications for the costly and highly regulated process of compliance reporting. Working with a group of representatives from industry and regulatory authorities, we employ the design science research methodology (DSR) in the design, development, and evaluation of an artefact, enabling the automated collection and enrichment of transactional data. Our findings indicate that DLT may facilitate the automation of key compliance processes through the implementation of a "pull-model", in which regulators can access compliance data in near real-time to stage aggregate exposures at the supranational level. Generalizing our preliminary results, we present four propositions on the implications of DLT in compliance. The findings contribute new practical insights on the topic of compliance to the growing IS discourse on DLT.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA DLT enabled smart mask system to enable social compliance

Robert Shorten, Pietro Ferraro, Lianna Zhao

6GENABLERS-DLT: DLT-based Marketplace for Decentralized Trading of 6G Telco resources

Angel Martin, Adriana Fernández-Fernández, Guillermo Gomez

No citations found for this paper.

Comments (0)