Summary

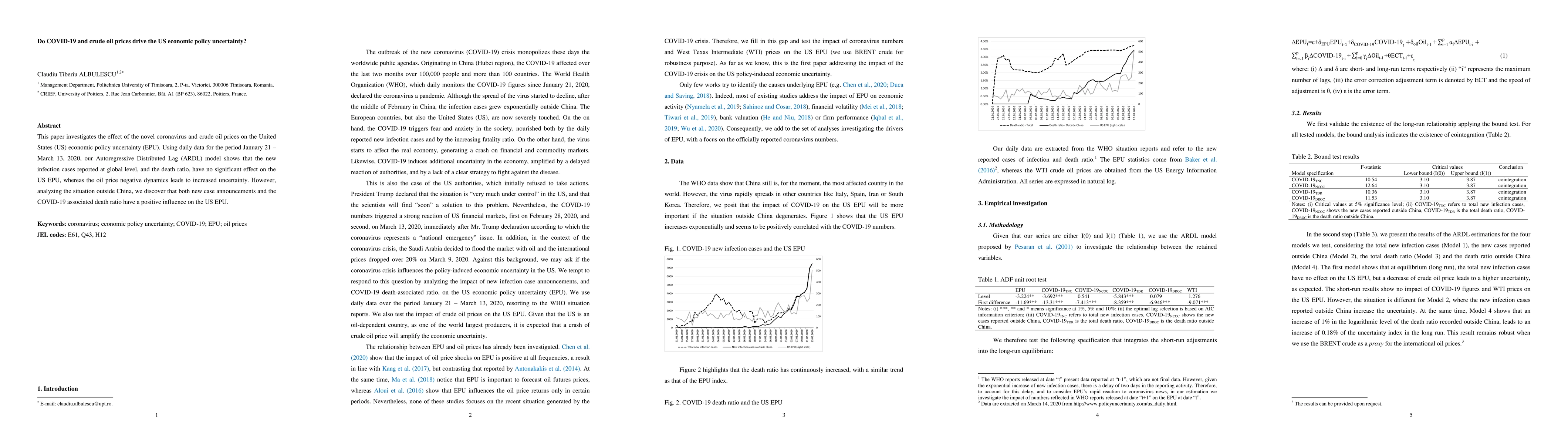

This paper investigates the effect of the novel coronavirus and crude oil prices on the United States (US) economic policy uncertainty (EPU). Using daily data for the period January 21-March 13, 2020, our Autoregressive Distributed Lag (ARDL) model shows that the new infection cases reported at global level, and the death ratio, have no significant effect on the US EPU, whereas the oil price negative dynamics leads to increased uncertainty. However, analyzing the situation outside China, we discover that both new case announcements and the COVID-19 associated death ratio have a positive influence on the US EPU.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)