Authors

Summary

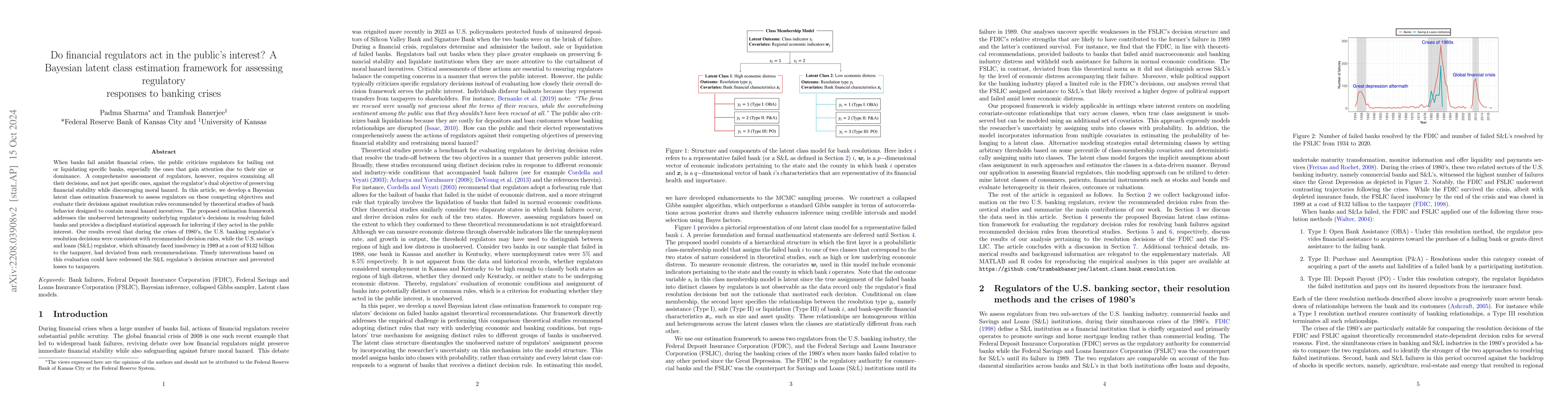

When banks fail amidst financial crises, the public criticizes regulators for bailing out or liquidating specific banks, especially the ones that gain attention due to their size or dominance. A comprehensive assessment of regulators, however, requires examining all their decisions, and not just specific ones, against the regulator's dual objective of preserving financial stability while discouraging moral hazard. In this article, we develop a Bayesian latent class estimation framework to assess regulators on these competing objectives and evaluate their decisions against resolution rules recommended by theoretical studies of bank behavior designed to contain moral hazard incentives. The proposed estimation framework addresses the unobserved heterogeneity underlying regulator's decisions in resolving failed banks and provides a disciplined statistical approach for inferring if they acted in the public interest. Our results reveal that during the crises of 1980's, the U.S. banking regulator's resolution decisions were consistent with recommended decision rules, while the U.S. savings and loans (S&L) regulator, which ultimately faced insolvency in 1989 at a cost of $132 billion to the taxpayer, had deviated from such recommendations. Timely interventions based on this evaluation could have redressed the S&L regulator's decision structure and prevented losses to taxpayers.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)