Authors

Summary

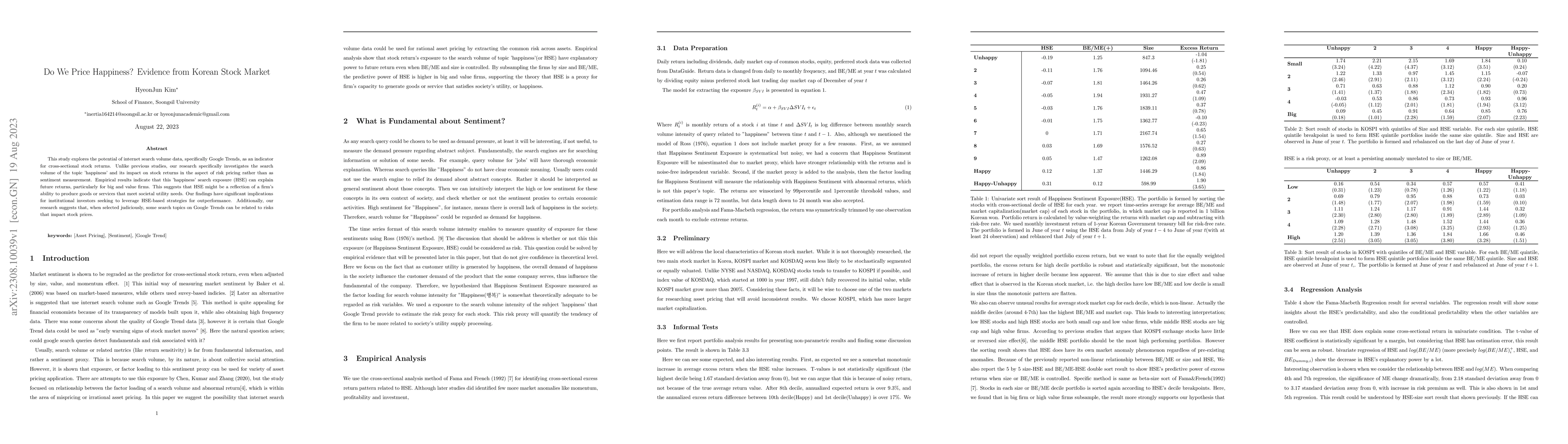

This study explores the potential of internet search volume data, specifically Google Trends, as an indicator for cross-sectional stock returns. Unlike previous studies, our research specifically investigates the search volume of the topic 'happiness' and its impact on stock returns in the aspect of risk pricing rather than as sentiment measurement. Empirical results indicate that this 'happiness' search exposure (HSE) can explain future returns, particularly for big and value firms. This suggests that HSE might be a reflection of a firm's ability to produce goods or services that meet societal utility needs. Our findings have significant implications for institutional investors seeking to leverage HSE-based strategies for outperformance. Additionally, our research suggests that, when selected judiciously, some search topics on Google Trends can be related to risks that impact stock prices.

AI Key Findings

Generated Aug 20, 2025

Methodology

The study uses Google Trends data to examine the relationship between internet search volume for 'happiness' and cross-sectional stock returns, focusing on risk pricing rather than sentiment measurement.

Key Results

- Happiness search exposure (HSE) can predict future stock returns, especially for large and value firms.

- HSE reflects a firm's capacity to provide goods or services that satisfy societal utility needs.

- The findings suggest that judiciously chosen Google Trends search topics can be linked to risks affecting stock prices.

Significance

This research is important for institutional investors looking to employ HSE-based strategies for superior performance and demonstrates the potential of Google Trends as a risk indicator in stock market analysis.

Technical Contribution

The paper introduces a novel approach to incorporating Google Trends data for risk pricing in stock market analysis.

Novelty

Unlike previous studies that use Google Trends for sentiment analysis, this research uniquely applies it to risk pricing by focusing on 'happiness' search volume as an indicator of societal utility satisfaction.

Limitations

- The study is limited to the Korean stock market, so generalizability to other markets remains uncertain.

- Reliance on search volume data might overlook other crucial factors influencing stock returns.

Future Work

- Explore the applicability of HSE in other stock markets and economic contexts.

- Investigate additional Google Trends topics as potential risk indicators for stock prices.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)