Authors

Summary

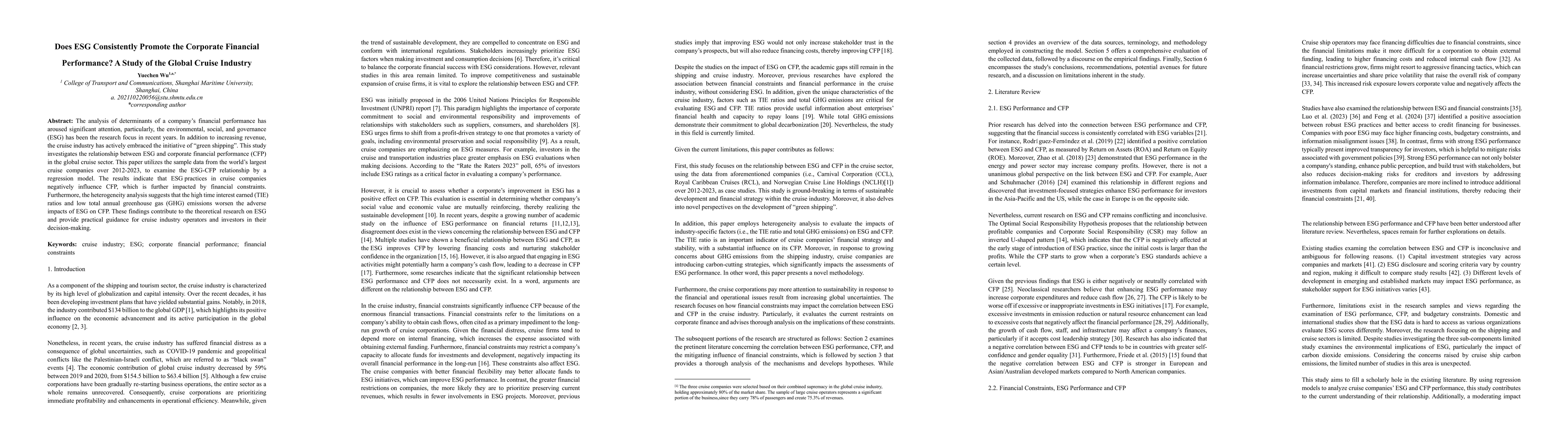

The analysis of determinants of a company's financial performance has aroused significant attention, particularly, the environmental, social, and governance (ESG) has been the research focus in recent years. In addition to increasing revenue, the cruise industry has actively embraced the initiative of "green shipping". This study investigates the relationship between ESG and corporate financial performance (CFP) in the global cruise sector. This paper utilizes the sample data from the world's largest cruise companies over 2012-2023, to examine the ESG-CFP relationship by a regression model. The results indicate that ESG practices in cruise companies negatively influence CFP, which is further impacted by financial constraints. Furthermore, the heterogeneity analysis suggests that the high time interest earned (TIE) ratios and low total annual greenhouse gas (GHG) emissions worsen the adverse impacts of ESG on CFP. These findings contribute to the theoretical research on ESG and provide practical guidance for cruise industry operators and investors in their decision-making.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersDoes ESG and Digital Transformation affects Corporate Sustainability? The Moderating role of Green Innovation

Chenglin Qing, Shanyue Jin

Study on the impact of trade policy uncertainty on the performance of enterprise ESG performance

Ye Lu, Hanqin Chen, Huaqin Huang

No citations found for this paper.

Comments (0)