Authors

Summary

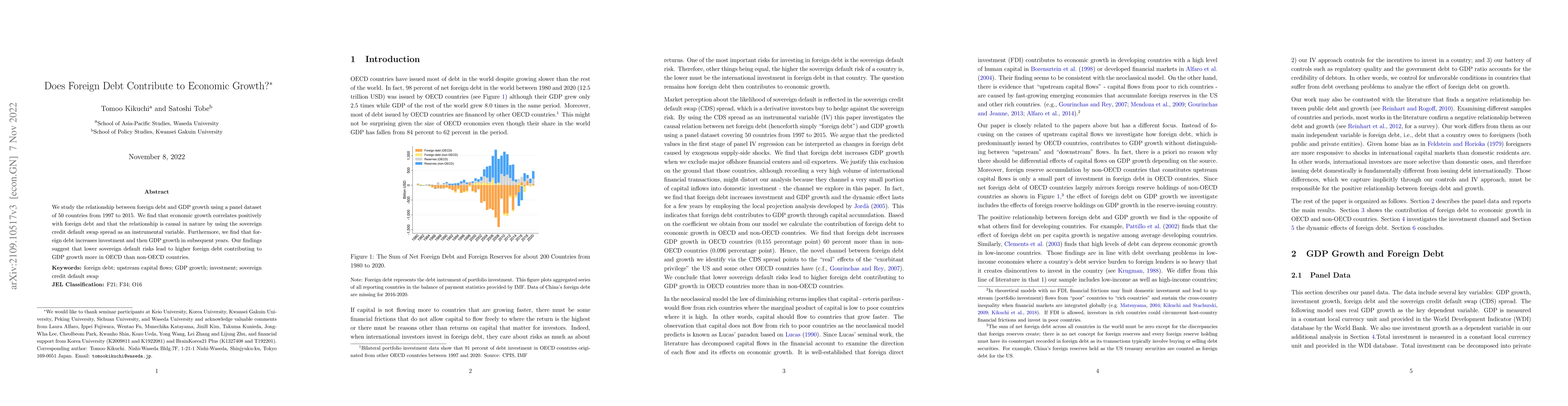

We study the relationship between foreign debt and GDP growth using a panel dataset of 50 countries from 1997 to 2015. We find that economic growth correlates positively with foreign debt and that the relationship is causal in nature by using the sovereign credit default swap spread as an instrumental variable. Furthermore, we find that foreign debt increases investment and then GDP growth in subsequent years. Our findings suggest that lower sovereign default risks lead to higher foreign debt contributing to GDP growth more in OECD than non-OECD countries.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersForeign Capital and Economic Growth: Evidence from Bangladesh

Ummya Salma, Md. Fazlul Huq Khan, Md. Masum Billah

Effect of Interest Payments on External Debt on Economic Growth in Kenya

Sammy Kemboi Chepkilot

| Title | Authors | Year | Actions |

|---|

Comments (0)