Summary

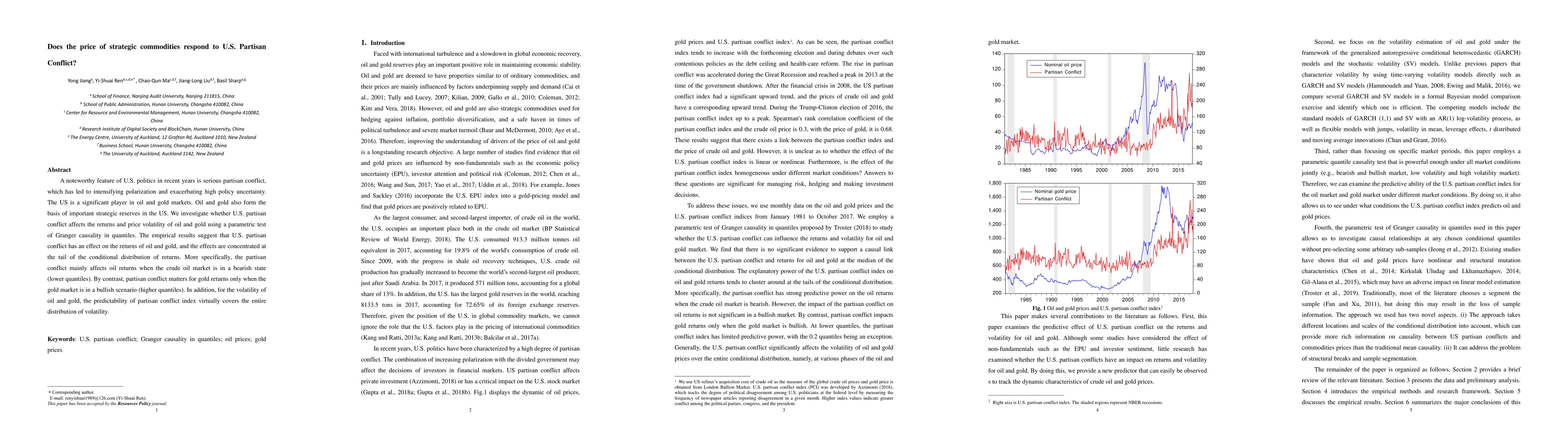

A noteworthy feature of U.S. politics in recent years is serious partisan conflict, which has led to intensifying polarization and exacerbating high policy uncertainty. The US is a significant player in oil and gold markets. Oil and gold also form the basis of important strategic reserves in the US. We investigate whether U.S. partisan conflict affects the returns and price volatility of oil and gold using a parametric test of Granger causality in quantiles. The empirical results suggest that U.S. partisan conflict has an effect on the returns of oil and gold, and the effects are concentrated at the tail of the conditional distribution of returns. More specifically, the partisan conflict mainly affects oil returns when the crude oil market is in a bearish state (lower quantiles). By contrast, partisan conflict matters for gold returns only when the gold market is in a bullish scenario (higher quantiles). In addition, for the volatility of oil and gold, the predictability of partisan conflict index virtually covers the entire distribution of volatility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHow Well Did U.S. Rail and Intermodal Freight Respond to the COVID-19 Pandemic vs. the Great Recession?

Max T. M. Ng, Hani S. Mahmassani, Joseph Schofer

| Title | Authors | Year | Actions |

|---|

Comments (0)