Summary

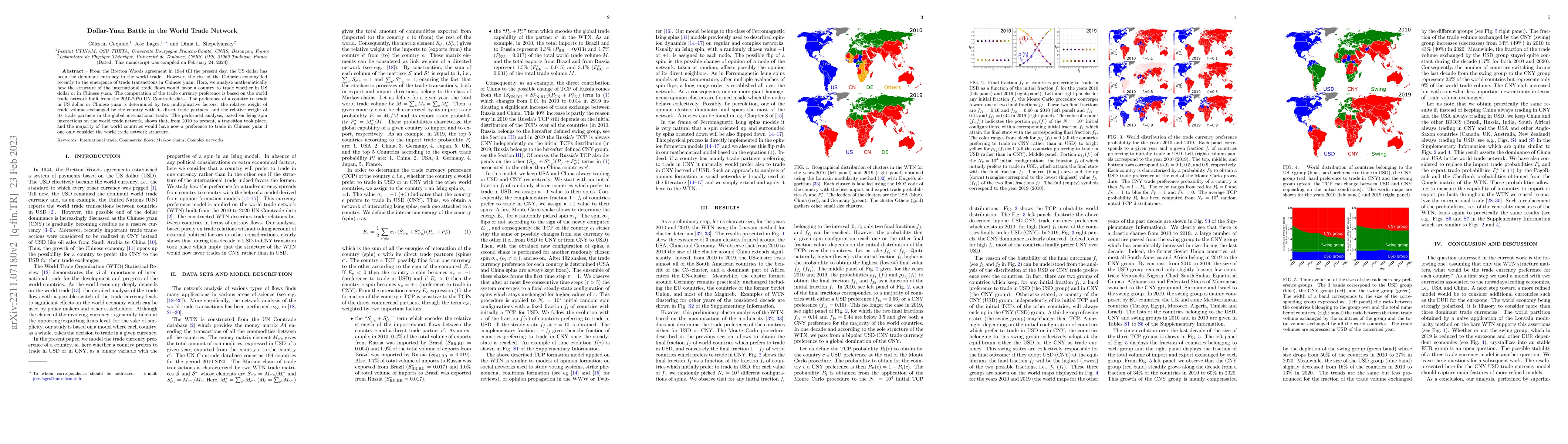

From the Bretton Woods agreement in 1944 till the present day, the US dollar has been the dominant currency in the world trade. However, the rise of the Chinese economy led recently to the emergence of trade transactions in Chinese yuan. Here, we analyze mathematically how the structure of the international trade flows would favor a country to trade whether in US dollar or in Chinese yuan. The computation of the trade currency preference is based on the world trade network built from the 2010-2020 UN Comtrade data. The preference of a country to trade in US dollar or Chinese yuan is determined by two multiplicative factors: the relative weight of trade volume exchanged by the country with its direct trade partners, and the relative weight of its trade partners in the global international trade. The performed analysis, based on Ising spin interactions on the world trade network, shows that, from 2010 to present, a transition took place, and the majority of the world countries would have now a preference to trade in Chinese yuan if one only consider the world trade network structure.

AI Key Findings

Generated Sep 02, 2025

Methodology

The study analyzes the structure of the international trade flows using the world trade network built from 2010-2020 UN Comtrade data. It employs Ising spin interactions on the world trade network to compute the trade currency preference, considering the relative weight of trade volume with direct partners and the relative weight of trade partners in global trade.

Key Results

- A transition from US dollar to Chinese yuan preference in world trade is identified based on the world trade network structure, with the majority of countries showing a preference for Chinese yuan from 2010 to the present.

- The analysis reveals two final fractions of countries preferring USD and CNY, depending on initial conditions, with the USD group consisting of countries like the US, Canada, UK, Australia, and New Zealand, and the CNY group including China, Brazil, Russia, India, and South Africa.

- Geographical distribution of clusters in the WTN shows the USA, China, and Germany as leaders across various years using the Louvain modularity method.

Significance

This research is important as it examines the shifting dynamics in global trade currencies, providing insights into the potential impact of China's economic rise on the dominance of the US dollar in international trade.

Technical Contribution

The paper introduces a methodology for analyzing currency preferences in the world trade network using Ising spin interactions, providing a quantitative approach to understanding shifts in trade currencies.

Novelty

This work differs from existing research by focusing on the structural aspects of the world trade network to predict currency preferences, rather than relying solely on economic indicators or qualitative assessments.

Limitations

- The study is limited to analyzing data from 2010 to 2020, and does not capture more recent developments or potential shifts in trade patterns.

- The findings are based on mathematical modeling and may not fully account for geopolitical, regulatory, or other external factors influencing currency preferences in international trade.

Future Work

- Further research could incorporate more recent data to assess the current state of USD and CNY preferences in international trade.

- Investigating the impact of geopolitical events, trade policies, and regulatory changes on currency preferences in the world trade network.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOpinion formation in the world trade network

Dima L. Shepelyansky, Célestin Coquidé, José Lages

| Title | Authors | Year | Actions |

|---|

Comments (0)