Authors

Summary

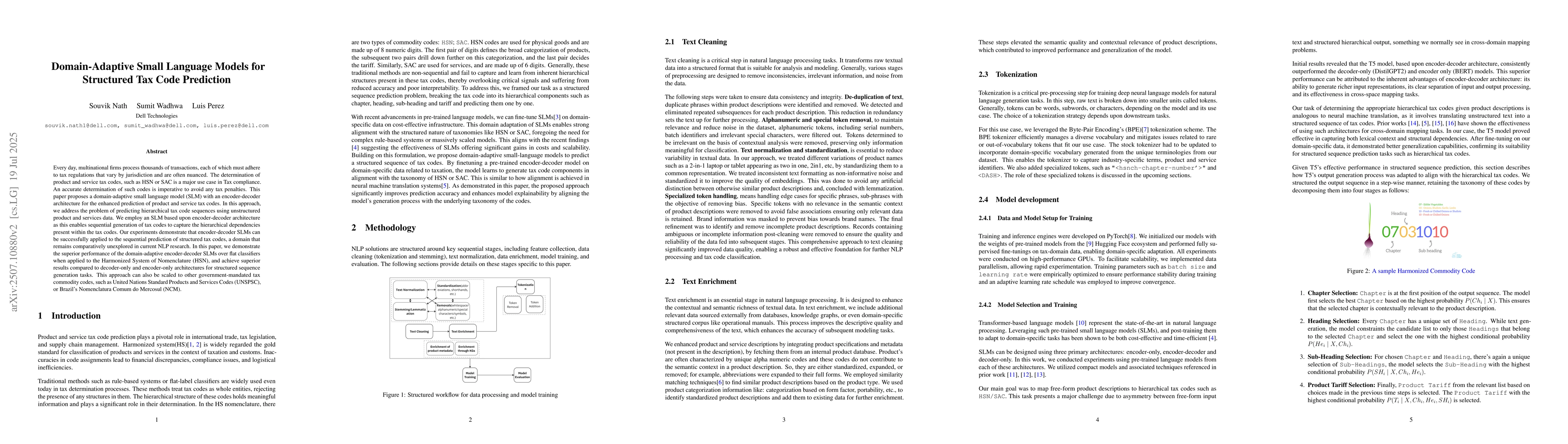

Every day, multinational firms process thousands of transactions, each of which must adhere to tax regulations that vary by jurisdiction and are often nuanced. The determination of product and service tax codes, such as HSN or SAC is a major use case in Tax compliance. An accurate determination of such codes is imperative to avoid any tax penalties. This paper proposes a domain-adaptive small language model (SLM) with an encoder-decoder architecture for the enhanced prediction of product and service tax codes. In this approach, we address the problem of predicting hierarchical tax code sequences using unstructured product and services data. We employ an SLM based upon encoder-decoder architecture as this enables sequential generation of tax codes to capture the hierarchical dependencies present within the tax codes. Our experiments demonstrate that encoder-decoder SLMs can be successfully applied to the sequential prediction of structured tax codes, a domain that remains comparatively unexplored in current NLP research. In this paper, we demonstrate the superior performance of the domain-adaptive encoder-decoder SLMs over flat classifiers when applied to the Harmonized System of Nomenclature (HSN), and achieve superior results compared to decoder-only and encoder-only architectures for structured sequence generation tasks. This approach can also be scaled to other government-mandated tax commodity codes, such as United Nations Standard Products and Services Codes (UNSPSC), or Brazil's Nomenclatura Comum do Mercosul (NCM).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDomain Adaptive Code Completion via Language Models and Decoupled Domain Databases

Bin Luo, Jidong Ge, Shangqing Liu et al.

Curriculum Learning for Small Code Language Models

Marwa Naïr, Kamel Yamani, Lynda Said Lhadj et al.

ALPINE: An adaptive language-agnostic pruning method for language models for code

Boqi Chen, Dániel Varró, Tushar Sharma et al.

No citations found for this paper.

Comments (0)