Summary

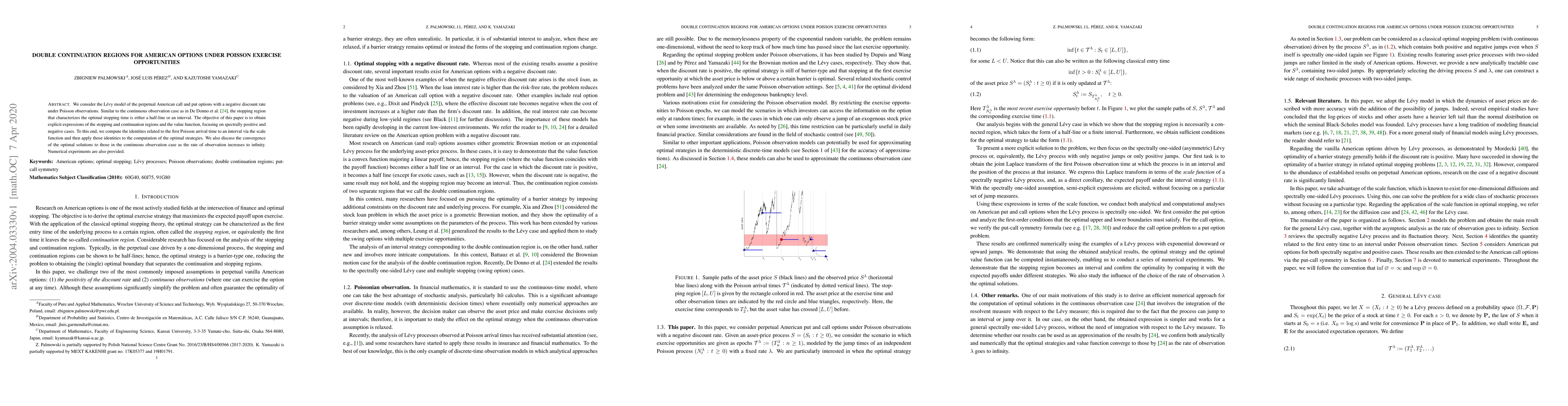

We consider the L\'evy model of the perpetual American call and put options with a negative discount rate under Poisson observations. Similar to the continuous observation case as in De Donno et al. [24], the stopping region that characterizes the optimal stopping time is either a half-line or an interval. The objective of this paper is to obtain explicit expressions of the stopping and continuation regions and the value function, focusing on spectrally positive and negative cases. To this end, we compute the identities related to the first Poisson arrival time to an interval via the scale function and then apply those identities to the computation of the optimal strategies. We also discuss the convergence of the optimal solutions to those in the continuous observation case as the rate of observation increases to infinity. Numerical experiments are also provided.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)