Summary

If financial markets displayed the informational efficiency postulated in the efficient markets hypothesis (EMH), arbitrage operations would be self-extinguishing. The present paper considers arbitrage sequences in foreign exchange (FX) markets, in which trading platforms and information are fragmented. In Kozyakin et al. (2010) and Cross et al. (2012) it was shown that sequences of triangular arbitrage operations in FX markets containing 4 currencies and trader-arbitrageurs tend to display periodicity or grow exponentially rather than being self-extinguishing. This paper extends the analysis to 5 or higher-order currency worlds. The key findings are that in a 5-currency world arbitrage sequences may also follow an exponential law as well as display periodicity, but that in higher-order currency worlds a double exponential law may additionally apply. There is an "inheritance of instability" in the higher-order currency worlds. Profitable arbitrage operations are thus endemic rather that displaying the self-extinguishing properties implied by the EMH.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

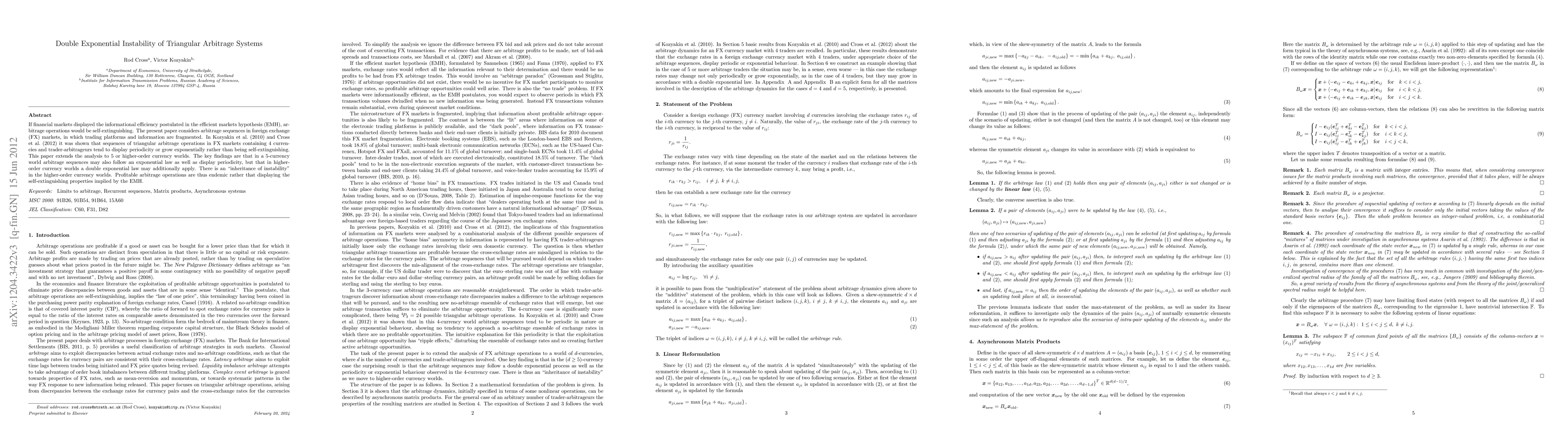

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)