Summary

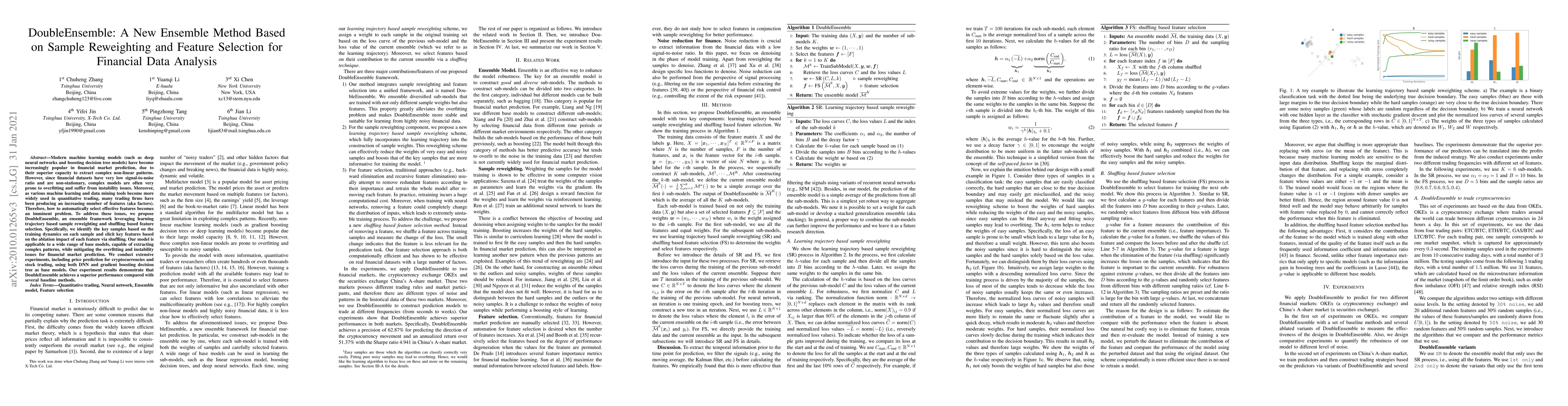

Modern machine learning models (such as deep neural networks and boosting decision tree models) have become increasingly popular in financial market prediction, due to their superior capacity to extract complex non-linear patterns. However, since financial datasets have very low signal-to-noise ratio and are non-stationary, complex models are often very prone to overfitting and suffer from instability issues. Moreover, as various machine learning and data mining tools become more widely used in quantitative trading, many trading firms have been producing an increasing number of features (aka factors). Therefore, how to automatically select effective features becomes an imminent problem. To address these issues, we propose DoubleEnsemble, an ensemble framework leveraging learning trajectory based sample reweighting and shuffling based feature selection. Specifically, we identify the key samples based on the training dynamics on each sample and elicit key features based on the ablation impact of each feature via shuffling. Our model is applicable to a wide range of base models, capable of extracting complex patterns, while mitigating the overfitting and instability issues for financial market prediction. We conduct extensive experiments, including price prediction for cryptocurrencies and stock trading, using both DNN and gradient boosting decision tree as base models. Our experiment results demonstrate that DoubleEnsemble achieves a superior performance compared with several baseline methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCorporate Financial Distress Prediction: Based on Multi-source Data and Feature Selection

Yi Ding, Chun Yan

A new weighted ensemble model for phishing detection based on feature selection

Farnoosh Shirani Bidabadi, Shuaifang Wang

| Title | Authors | Year | Actions |

|---|

Comments (0)