Summary

Regression analysis has always been a hot research topic in statistics. We propose a very flexible semi-parametric regression model called Elliptical Copula Regression (ECR) model, which covers a large class of linear and nonlinear regression models such as additive regression model,single index model. Besides, ECR model can capture the heavy-tail characteristic and tail dependence between variables, thus it could be widely applied in many areas such as econometrics and finance. In this paper we mainly focus on the feature screening problem for ECR model in ultra-high dimensional setting. We propose a doubly robust sure screening procedure for ECR model, in which two types of correlation coefficient are involved: Kendall tau correlation and Canonical correlation. Theoretical analysis shows that the procedure enjoys sure screening property, i.e., with probability tending to 1, the screening procedure selects out all important variables and substantially reduces the dimensionality to a moderate size against the sample size. Thorough numerical studies are conducted to illustrate its advantage over existing sure independence screening methods and thus it can be used as a safe replacement of the existing procedures in practice. At last, the proposed procedure is applied on a gene-expression real data set to show its empirical usefulness.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

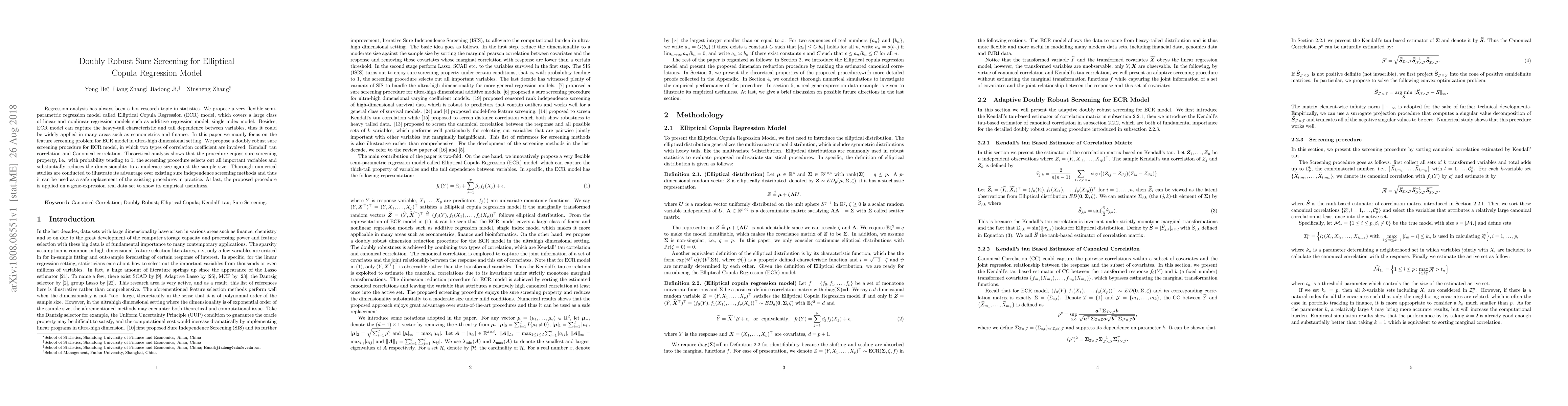

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust Sure Independence Screening for Non-polynomial dimensional Generalized Linear Models

Abhik Ghosh, Magne Thoresen, Erica Ponzi et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)