Authors

Summary

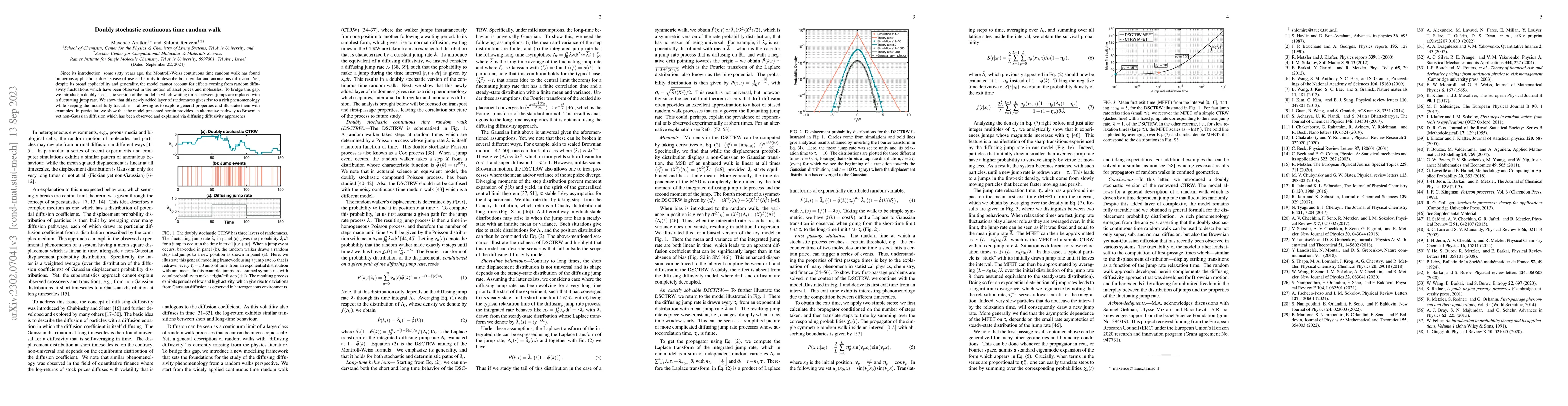

Since its introduction, some sixty years ago, the Montroll-Weiss continuous time random walk has found numerous applications due its ease of use and ability to describe both regular and anomalous diffusion. Yet, despite its broad applicability and generality, the model cannot account for effects coming from random diffusivity fluctuations which have been observed in the motion of asset prices and molecules. To bridge this gap, we introduce a doubly stochastic version of the model in which waiting times between jumps are replaced with a fluctuating jump rate. We show that this newly added layer of randomness gives rise to a rich phenomenology while keeping the model fully tractable -- allowing us to explore general properties and illustrate them with examples. In particular, we show that the model presented herein provides an alternative pathway to Brownian yet non-Gaussian diffusion which has been observed and explained via diffusing diffusivity approaches.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)