Authors

Summary

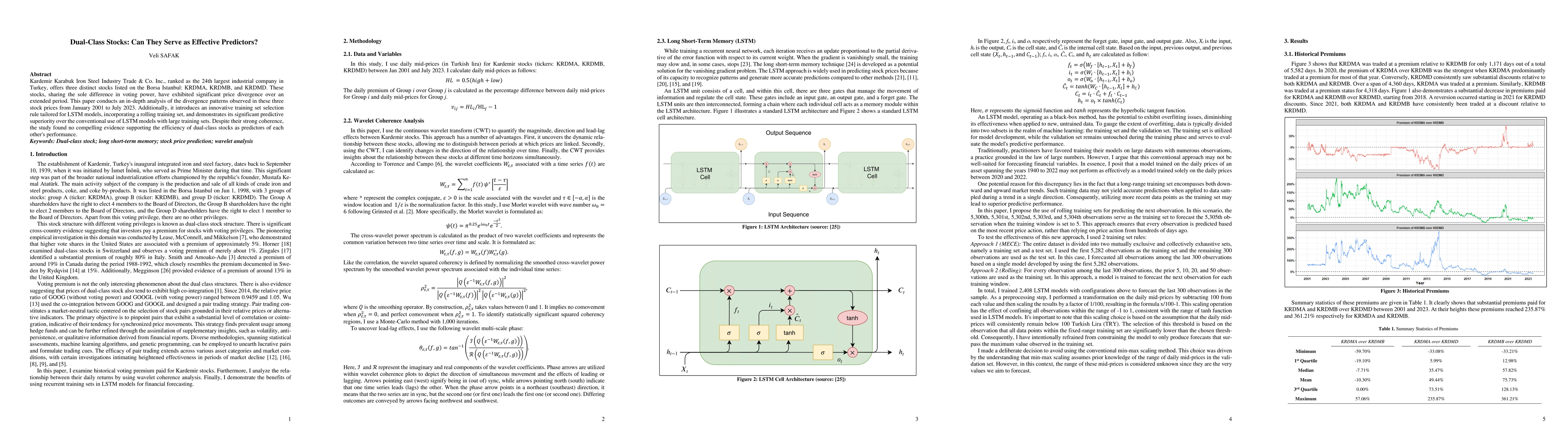

Kardemir Karabuk Iron Steel Industry Trade & Co. Inc., ranked as the 24th largest industrial company in Turkey, offers three distinct stocks listed on the Borsa Istanbul: KRDMA, KRDMB, and KRDMD. These stocks, sharing the sole difference in voting power, have exhibited significant price divergence over an extended period. This paper conducts an in-depth analysis of the divergence patterns observed in these three stock prices from January 2001 to July 2023. Additionally, it introduces an innovative training set selection rule tailored for LSTM models, incorporating a rolling training set, and demonstrates its significant predictive superiority over the conventional use of LSTM models with large training sets. Despite their strong correlation, the study found no compelling evidence supporting the efficiency of dual-class stocks as predictors of each other's performance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCan Language Models Serve as Text-Based World Simulators?

Marc-Alexandre Côté, Xingdi Yuan, Ziang Xiao et al.

Can Large Language Models Serve as Evaluators for Code Summarization?

Ye Liu, Yang Wu, Philip S. Yu et al.

Resonantly-driven nanopores can serve as nanopumps

Benno Liebchen, Somnath Bhattacharyya, Steffen Hardt et al.

Optimizing Diffusion Noise Can Serve As Universal Motion Priors

Siyu Tang, Thabo Beeler, Supasorn Suwajanakorn et al.

No citations found for this paper.

Comments (0)