Summary

Convex Hull (CH) pricing, used in US electricity markets and raising interest in Europe, is a pricing rule designed to handle markets with non-convexities such as startup costs and minimum up and down times. In such markets, the market operator makes side payments to generators to cover lost opportunity costs, and CH prices minimize the total "lost opportunity costs", which include both actual losses and missed profit opportunities. These prices can also be obtained by solving a (partial) Lagrangian dual of the original mixed-integer program, where power balance constraints are dualized. Computing CH prices then amounts to minimizing a sum of nonsmooth convex objective functions, where each term depends only on a single generator. The subgradient of each of those terms can be obtained independently by solving smaller mixed-integer programs. In this work, we benchmark a large panel of first-order methods to solve the above dual CH pricing problem. We test several dual methods, most of which not previously considered for CH pricing, namely a proximal variant of the bundle level method, subgradient methods with three different stepsize strategies, two recent parameter-free methods and an accelerated gradient method combined with smoothing. We compare those methods on two representative sets of real-world large-scale instances and complement the comparison with a (Dantzig-Wolfe) primal column generation method shown to be efficient at computing CH prices, for reference. Our numerical experiments show that the bundle proximal level method and two variants of the subgradient method perform the best among all dual methods and compare favorably with the Dantzig-Wolfe primal method.

AI Key Findings

Generated Jun 10, 2025

Methodology

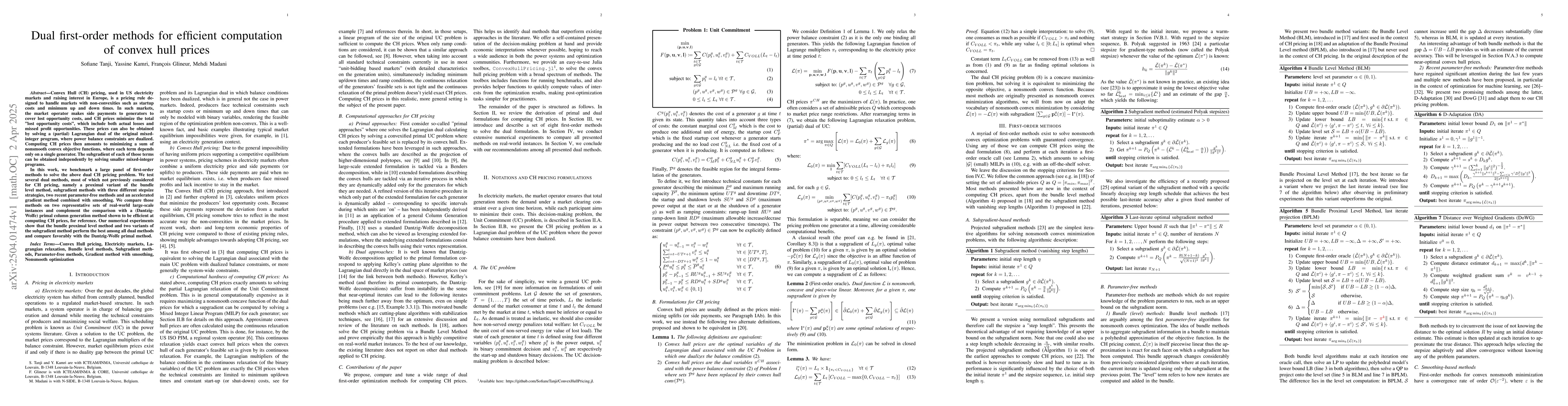

The paper proposes a computational study using first-order methods applied to dual formulations for computing Convex Hull (CH) prices in electricity markets. It benchmarks various methods, including proximal bundle level methods, subgradient methods with different stepsize strategies, parameter-free methods, and an accelerated gradient method combined with smoothing.

Key Results

- Subgradient methods, especially those using estimated Polyak stepsizes and the last-iterate optimal variant, are found to be competitive with bundle methods.

- Bundle Level Methods (BLM) and Bundle Proximal Level Methods (BPLM) perform well, with BPLM operating on average 75% faster than SUBG-L in the Belgian dataset.

- In the Californian dataset, SUBG-EP achieves results nearly three times faster than the second-fastest method.

- Smooth approximation of the dual CH pricing problem using FGM shows promising results on the Californian dataset.

- Primal methods, such as Dantzig-Wolfe decomposition, are competitive for small numbers of producers but suffer from numerical instability with larger numbers.

Significance

This research is significant as it identifies competitive methods for computing CH prices, which are crucial for handling non-convexities in electricity markets. It also proposes a hybrid scheme for practical solvers combining subgradient methods with bundle methods.

Technical Contribution

The paper introduces a comprehensive benchmark of first-order methods for dual formulations of CH pricing, proposing novel combinations and tuning strategies to enhance computational efficiency.

Novelty

The paper highlights the competitiveness of subgradient methods, previously overlooked in the community, and introduces a hybrid solver scheme combining subgradient methods with bundle methods for practical applications.

Limitations

- Parameter-free methods require a large number of steps before reaching their asymptotically optimal convergence regime, making them non-competitive within the 15-minute time constraint.

- The study is limited to first-order methods and does not explore second-order or higher-order methods.

Future Work

- Further analysis of how decomposition methods applied to Extended Formulations could be leveraged for computing CH prices.

- Exploration of primal methods' efficiency and stability with varying numbers of producers.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFirst-order methods for the convex hull membership problem

Douglas S. Gonçalves, Luiz-Rafael Santos, Rafaela Filippozzi

Accelerating the Convex Hull Computation with a Parallel GPU Algorithm

Cristóbal A. Navarro, Héctor Ferrada, Alan Keith

No citations found for this paper.

Comments (0)