Summary

We give a dual representation of minimal supersolutions of BSDEs with non-bounded, but integrable terminal conditions and under weak requirements on the generator which is allowed to depend on the value process of the equation. Conversely, we show that any dynamic risk measure satisfying such a dual representation stems from a BSDE. We also give a condition under which a supersolution of a BSDE is even a solution.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

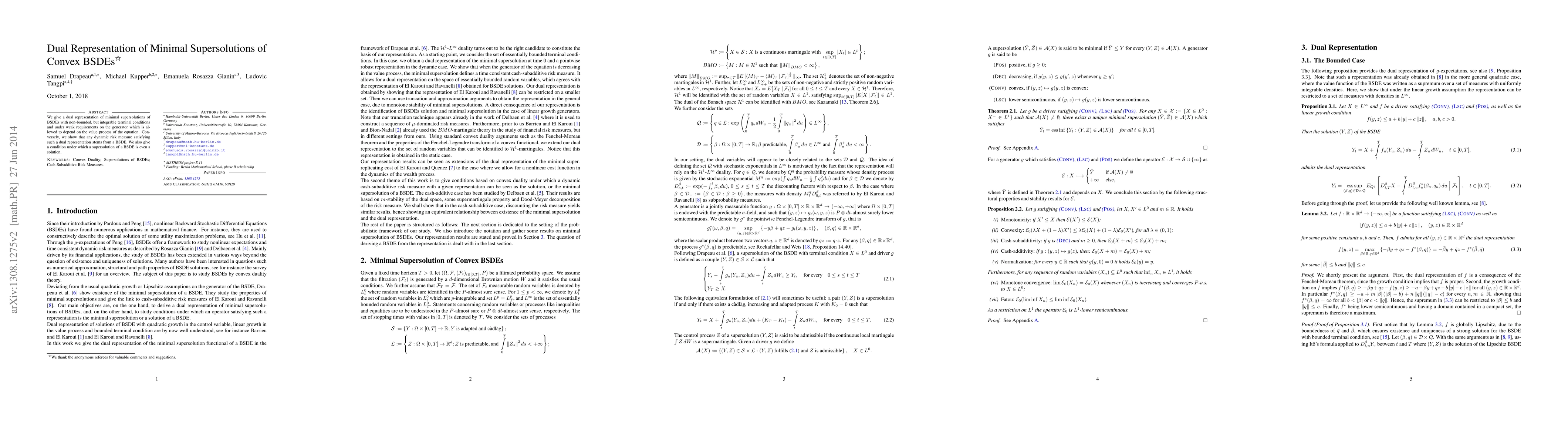

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)