Authors

Summary

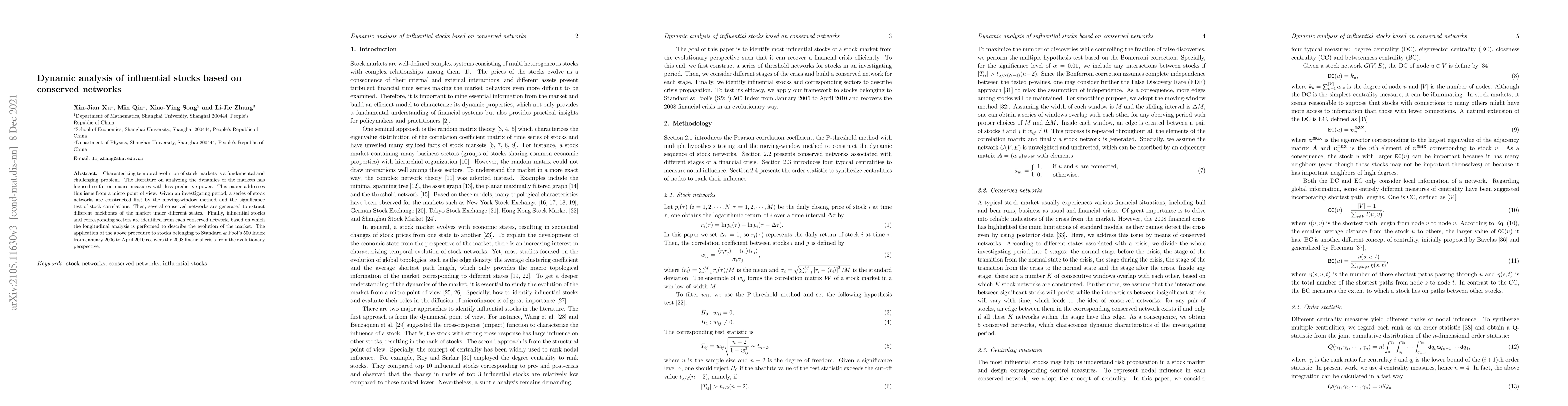

Characterizing temporal evolution of stock markets is a fundamental and challenging problem. The literature on analyzing the dynamics of the markets has focused so far on macro measures with less predictive power. This paper addresses this issue from a micro point of view. Given an investigating period, a series of stock networks are constructed first by the moving-window method and the significance test of stock correlations. Then, several conserved networks are generated to extract different backbones of the market under different states. Finally, influential stocks and corresponding sectors are identified from each conserved network, based on which the longitudinal analysis is performed to describe the evolution of the market. The application of the above procedure to stocks belonging to Standard \& Pool's 500 Index from January 2006 to April 2010 recovers the 2008 financial crisis from the evolutionary perspective.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)