Summary

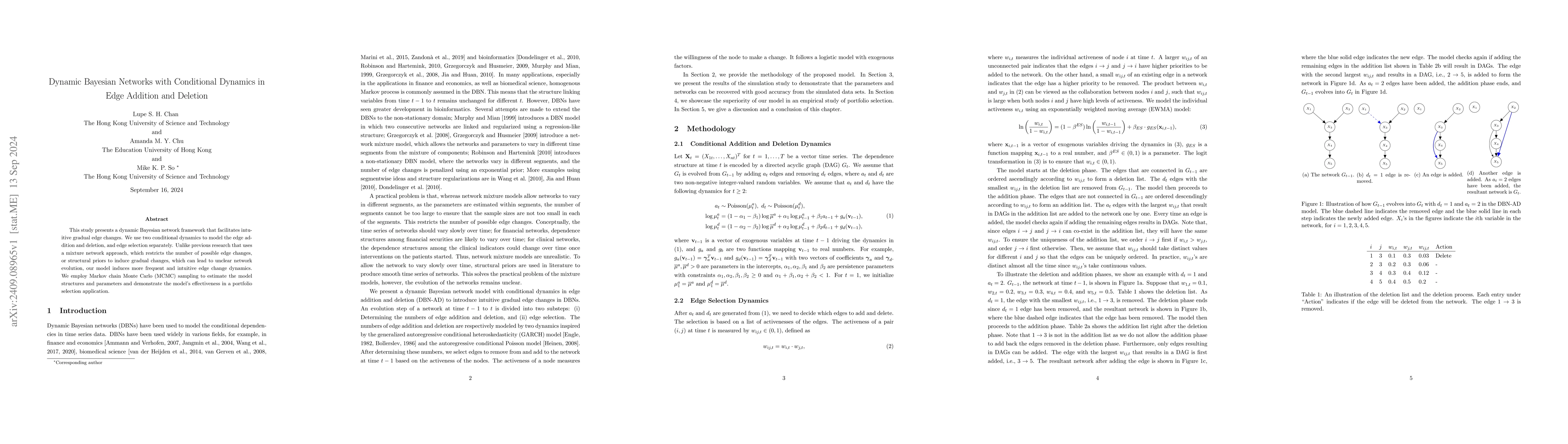

This study presents a dynamic Bayesian network framework that facilitates intuitive gradual edge changes. We use two conditional dynamics to model the edge addition and deletion, and edge selection separately. Unlike previous research that uses a mixture network approach, which restricts the number of possible edge changes, or structural priors to induce gradual changes, which can lead to unclear network evolution, our model induces more frequent and intuitive edge change dynamics. We employ Markov chain Monte Carlo (MCMC) sampling to estimate the model structures and parameters and demonstrate the model's effectiveness in a portfolio selection application.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Impact of Node Addition and Deletion on Network Production Fluctuations

Mahdi Kohan Sefidi

No citations found for this paper.

Comments (0)