Summary

We build on the theory of capital requirements (CRs) to create a new framework for modeling dynamic risk preferences. The key question is how to evaluate the risk of a payoff stream sequentially as new information is revealed. In our model, we associate each payoff stream with a disbursement strategy and a premium schedule to form a triple of stochastic processes. We characterize risk preferences in terms of a single set that we call the risk frontier which characterizes acceptable triples. We then propose the generalized capital requirement (GCR) which evaluates the risk of a payoff stream by minimizing the premium schedule over acceptable triples. We apply this model to a risk-aware decision maker (DM) who controls a Markov decision process (MDP) and wants to find a policy to minimize the GCR of its payoff stream. The resulting GCR-MDP recovers many well-known risk-aware MDPs as special cases. To make this approach computationally viable, we obtain the temporal decomposition of the GCR in terms of the risk frontier. Then, we connect the temporal decomposition with the notion of an information state to compactly capture the dependence of DM's risk preferences on the problem history, where augmented dynamic programming can be used to compute an optimal policy. We report numerical experiments for the GCR-minimizing newsvendor.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

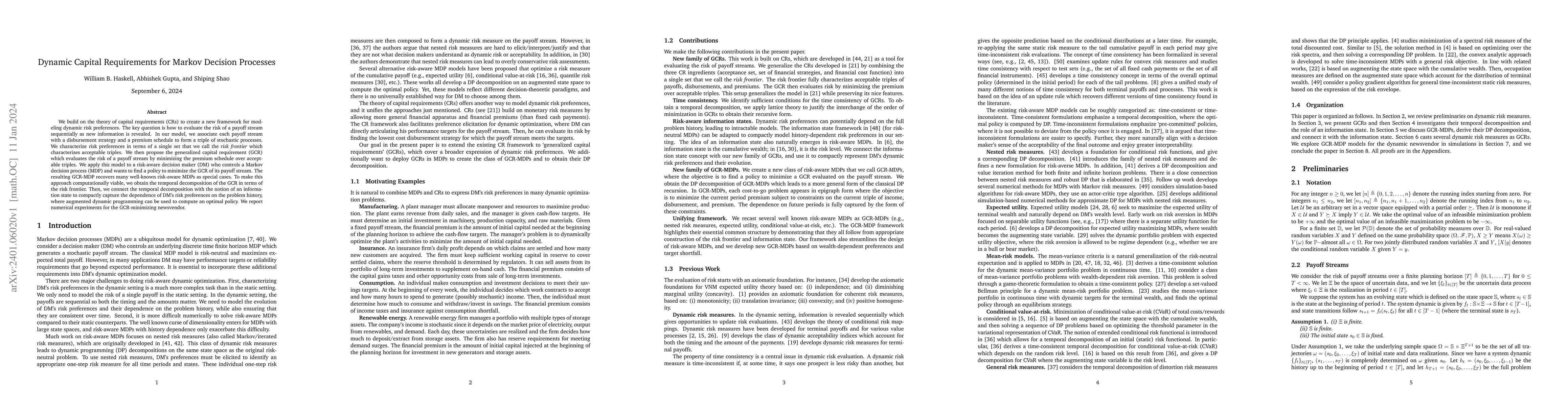

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamic Regret of Online Markov Decision Processes

Peng Zhao, Zhi-Hua Zhou, Long-Fei Li

No citations found for this paper.

Comments (0)