Summary

In this paper we present a theoretical framework for determining dynamic ask and bid prices of derivatives using the theory of dynamic coherent acceptability indices in discrete time. We prove a version of the First Fundamental Theorem of Asset Pricing using the dynamic coherent risk measures. We introduce the dynamic ask and bid prices of a derivative contract in markets with transaction costs. Based on these results, we derive a representation theorem for the dynamic bid and ask prices in terms of dynamically consistent sequence of sets of probability measures and risk-neutral measures. To illustrate our results, we compute the ask and bid prices of some path-dependent options using the dynamic Gain-Loss Ratio.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

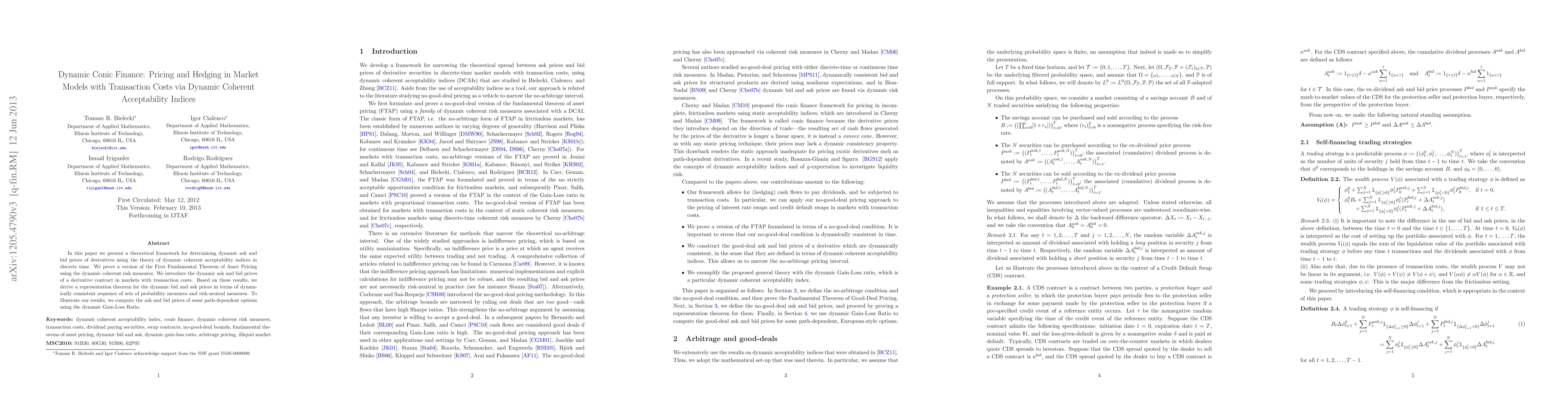

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)